In the fast-paced world of trading, staying ahead of the curve is crucial. One of the most effective tools for achieving this is the live chart. This article delves into the importance of trading live charts, offering insights into how they can enhance your trading strategy and improve your decision-making process.

Understanding Live Charts

A live chart is a dynamic visual representation of financial market data. It provides real-time updates on asset prices, making it an invaluable tool for traders looking to make informed decisions. Unlike static charts, live charts are constantly updated, reflecting the latest market movements and trends.

Key Features of Live Charts

Real-Time Data: The most significant advantage of live charts is their ability to provide real-time data. This feature allows traders to stay updated with the latest market movements, enabling them to react quickly and make informed decisions.

Technical Indicators: Live charts come with a variety of technical indicators, such as moving averages, RSI, and Fibonacci retracement levels. These indicators help traders analyze market trends and identify potential entry and exit points.

Customization: Live charts can be customized to suit individual trading preferences. Traders can choose from different time frames, chart types, and indicators to suit their trading style.

Benefits of Using Live Charts

Improved Decision-Making: By having access to real-time data and technical indicators, traders can make more informed decisions. This can lead to better risk management and increased profitability.

Enhanced Market Analysis: Live charts provide traders with a comprehensive view of the market, allowing them to analyze trends, patterns, and potential opportunities.

Competitive Edge: Traders who use live charts have a competitive edge over those who rely on static charts. The ability to stay updated with the latest market movements can help traders make timely decisions and capitalize on opportunities.

Case Study: Live Chart Analysis in Cryptocurrency Trading

Let's consider a hypothetical scenario in which a trader is analyzing the live chart of Bitcoin. The chart shows that Bitcoin has been trending upwards over the past few days, with strong support levels at

Using technical indicators, the trader notices that the RSI is currently at 70, indicating that Bitcoin is overbought. However, the moving averages are still trending upwards, suggesting that the overall trend remains bullish.

Based on this analysis, the trader decides to enter a long position at

Conclusion

In conclusion, trading live charts is an essential tool for traders looking to stay ahead of the curve. By providing real-time data, technical indicators, and customization options, live charts can enhance your trading strategy and improve your decision-making process. Whether you're trading stocks, cryptocurrencies, or other financial assets, mastering the use of live charts can give you a significant competitive edge in the market.

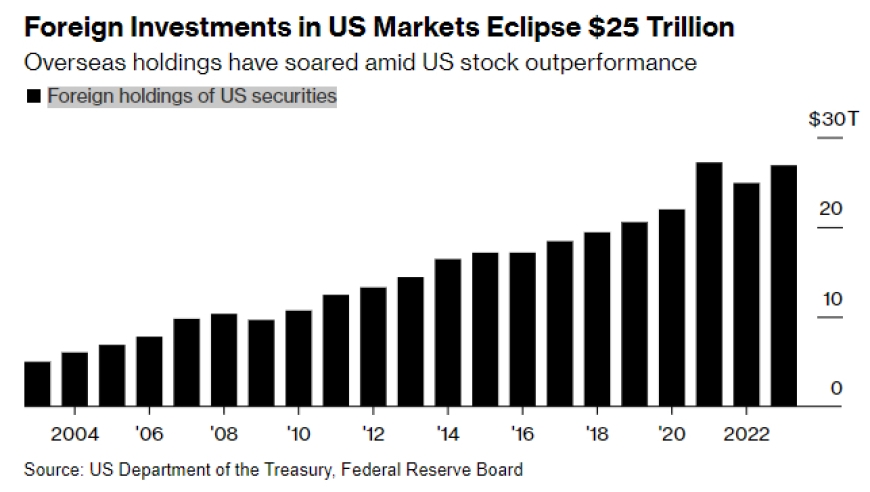

US stock market