In the fast-paced world of investing, staying ahead of the curve is crucial. One tool that can help you do just that is summary stocks. But what exactly are summary stocks, and how can they benefit your investment strategy? In this article, we'll delve into the ins and outs of summary stocks, providing you with a comprehensive guide to help you make informed decisions.

What Are Summary Stocks?

Summary stocks, also known as stock summaries, are concise, informative snapshots of a company's financial health. They offer a quick overview of key metrics such as price, market cap, earnings, and revenue. By condensing complex information into an easily digestible format, summary stocks enable investors to quickly assess a company's potential.

The Benefits of Using Summary Stocks

Efficiency: In the age of information overload, summary stocks save you time by presenting only the most critical data. This allows you to focus on making well-informed decisions without getting bogged down in unnecessary details.

Risk Management: Summary stocks help you identify companies with high growth potential while minimizing the risk of investing in troubled or declining stocks. By analyzing key metrics, you can make more calculated decisions.

Market Trends: By keeping an eye on summary stocks, you can stay updated on market trends and identify emerging opportunities. This can help you capitalize on hot sectors and invest in companies poised for growth.

How to Use Summary Stocks Effectively

Start with the Basics: Begin by familiarizing yourself with the key metrics found in summary stocks, such as price, market cap, earnings, and revenue. Understanding these terms will allow you to make more informed decisions.

Compare and Contrast: Use summary stocks to compare different companies within the same industry. This can help you identify the best-performing companies and understand the factors contributing to their success.

Long-Term Perspective: While summary stocks provide valuable insights, it's essential to consider them in the context of your long-term investment strategy. Keep in mind your risk tolerance and investment goals when making decisions.

Case Study: Apple Inc.

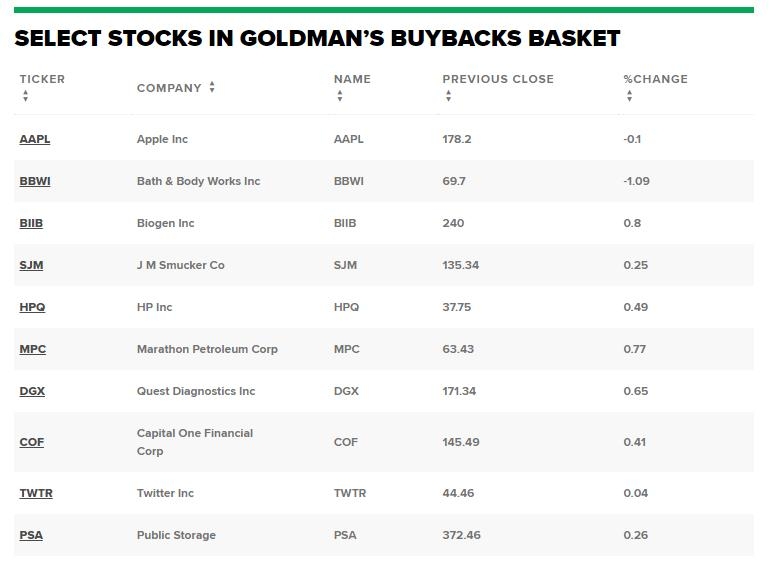

Let's take a look at a real-world example. Apple Inc. (AAPL) is a prime example of a company that has thrived due to its summary stock performance. Over the years, Apple has consistently reported strong earnings, high revenue, and a growing market cap. By analyzing its summary stock, investors can see that Apple is a stable, profitable company with strong growth potential.

Final Thoughts

In conclusion, summary stocks are an invaluable tool for investors looking to stay informed and make well-informed decisions. By understanding the key metrics and using them effectively, you can identify promising investment opportunities and manage your portfolio with confidence. So, the next time you're considering an investment, don't forget to take a quick glance at the summary stock to get a clear picture of the company's financial health.

US stock market