In today's rapidly evolving energy sector, lithium stocks have become a cornerstone for investors looking to capitalize on the burgeoning electric vehicle (EV) market. With the increasing demand for lithium-ion batteries, companies specializing in this crucial metal have seen a surge in interest. This article delves into the top lithium stocks in the US, offering insights into their potential and risks.

Understanding Lithium Stocks

Lithium is a vital component in the production of lithium-ion batteries, which power everything from smartphones to electric vehicles. The demand for lithium has skyrocketed as the global shift towards sustainable energy continues. As such, investing in lithium stocks can be a smart move for those looking to ride the wave of this trend.

Top Lithium Stocks in the US

Albemarle Corporation (ALB) Key Highlights:

Lithium Americas (LAC) Key Highlights:

Bacanora Minerals (BCN)

Sociedad Química y Minera de Chile (SQM)

Western Lithium (WLC)

Investment Considerations

When considering investing in lithium stocks, it's crucial to weigh the potential benefits against the risks. The lithium market is subject to significant volatility due to factors such as supply and demand dynamics, geopolitical events, and technological advancements. Investors should conduct thorough research and consider seeking advice from a financial advisor before making any investment decisions.

Conclusion

Investing in lithium stocks can be a lucrative opportunity for those looking to capitalize on the growing demand for sustainable energy. By understanding the key players in the market and their respective strengths and weaknesses, investors can make informed decisions about where to allocate their capital. As the world continues to transition towards cleaner energy sources, the potential for growth in the lithium sector remains substantial.

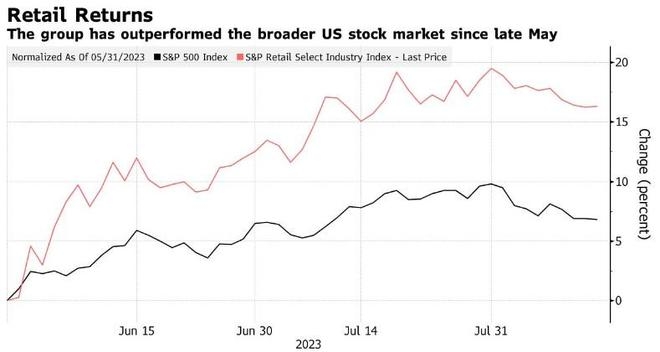

US stock market