Investing in the stock market can be a daunting task, especially for beginners. One of the most critical tools for understanding market trends and making informed investment decisions is the S&P 500 return historical chart. This article delves into the significance of this chart, its historical data, and how it can help investors predict future market movements.

Understanding the S&P 500 Return Historical Chart

The S&P 500 return historical chart is a visual representation of the performance of the S&P 500 index over a specific period. The S&P 500 is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. This index is widely regarded as a benchmark for the U.S. stock market and is often used to gauge the overall health of the economy.

The chart typically displays the index's value over time, with the x-axis representing the date and the y-axis representing the index's value. By analyzing this chart, investors can gain insights into the market's past performance, identify trends, and make more informed decisions.

Key Takeaways from the S&P 500 Return Historical Chart

Long-Term Growth: Over the long term, the S&P 500 has consistently delivered positive returns. This chart demonstrates that investing in the stock market can be a powerful tool for building wealth over time.

Market Cycles: The S&P 500 return historical chart clearly shows the cyclical nature of the stock market. Investors can identify periods of growth, correction, and recession by examining the chart.

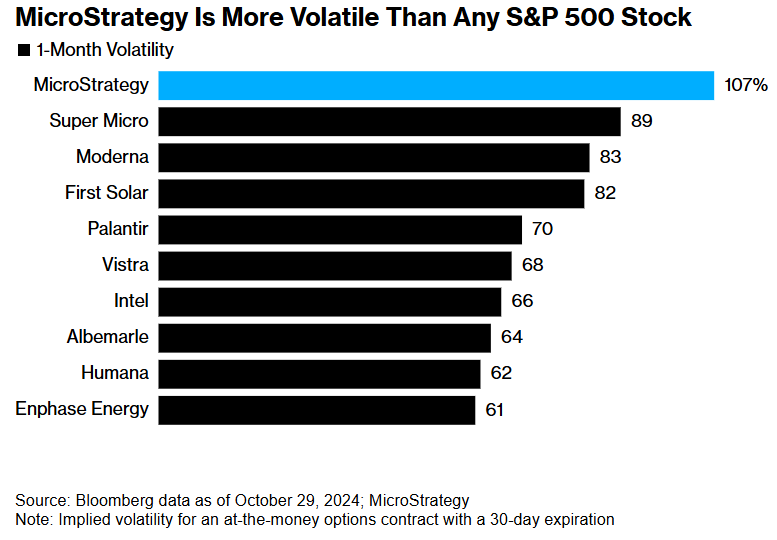

Volatility: The chart also highlights the volatility of the stock market. While the long-term trend is upward, there are periods of significant price fluctuations that can impact investor sentiment.

Economic Indicators: The S&P 500 return historical chart can be used to analyze the relationship between the stock market and economic indicators, such as GDP growth, unemployment rates, and inflation.

Case Studies: Analyzing Past Performance

To illustrate the importance of the S&P 500 return historical chart, let's look at a few case studies:

2008 Financial Crisis: The chart shows a sharp decline in the S&P 500 index in 2008, mirroring the global financial crisis. Investors who analyzed this chart could have anticipated the market's downturn and taken appropriate action to protect their investments.

Tech Bubble Burst: In the early 2000s, the tech sector experienced a massive bubble, which eventually burst. The S&P 500 return historical chart shows a significant drop in the index during this period, highlighting the risks associated with investing in specific sectors.

Recovery Post-2008: The chart also demonstrates the market's resilience and ability to recover from major downturns. After the 2008 financial crisis, the S&P 500 index rebounded strongly, providing investors with an opportunity to capitalize on the market's recovery.

Conclusion

The S&P 500 return historical chart is a valuable tool for investors looking to understand the stock market's past performance and make informed decisions. By analyzing this chart, investors can identify market trends, anticipate future movements, and protect their investments. Whether you're a beginner or an experienced investor, the S&P 500 return historical chart is a resource you can't afford to ignore.

stock technical analysis