In the ever-evolving landscape of international investments, the announcement of the Saudi Aramco stock buy in the US market has generated significant buzz. For global investors, this move could represent a golden opportunity to tap into one of the world’s largest and most profitable oil companies. This article delves into the details of the Saudi Aramco stock buy in the US, highlighting its implications and potential benefits.

Understanding Saudi Aramco

Firstly, let’s understand what Saudi Aramco is. It is the state-owned oil company of Saudi Arabia, responsible for the country’s vast oil reserves. The company has a market capitalization of over $1 trillion, making it one of the most valuable companies in the world. The decision to list its shares in the US market is a significant step in its corporate history.

The US Listing

In December 2019, Saudi Aramco became the first company in history to list its shares on the Saudi Stock Exchange (Tadawul). However, the real excitement began when it was announced that the company would also list its shares on the New York Stock Exchange (NYSE). This move allowed investors around the globe to purchase shares in the world’s largest oil producer.

Benefits of the Saudi Aramco Stock Buy in the US

There are several reasons why the Saudi Aramco stock buy in the US is a game-changer for global investors:

1. Market Accessibility

The US listing makes it easier for international investors to purchase shares in Saudi Aramco. This increased accessibility can potentially lead to higher trading volumes and liquidity.

2. Investment Diversification

Investors can diversify their portfolios by investing in Saudi Aramco. As one of the world’s largest oil companies, it offers a unique investment opportunity that is not easily replicated in other sectors.

3. Potential for High Returns

Saudi Aramco is known for its strong financial performance. The company has reported record profits in recent years, and there is a high expectation that the company will continue to generate significant returns for investors.

Case Study: The BP-Saudi Aramco Partnership

A notable example of the potential benefits of investing in Saudi Aramco is the partnership between BP and the company. In 2019, BP became a minority shareholder in Saudi Aramco, investing $10 billion in the company. This move has provided BP with access to Saudi Aramco’s extensive resources and has been a significant driver of its own growth.

Conclusion

The Saudi Aramco stock buy in the US market presents a compelling investment opportunity for global investors. With its strong financial performance and market accessibility, it could potentially be a valuable addition to any investor’s portfolio. As the world continues to navigate the complexities of the energy sector, the presence of Saudi Aramco on the global stage is likely to become even more significant.

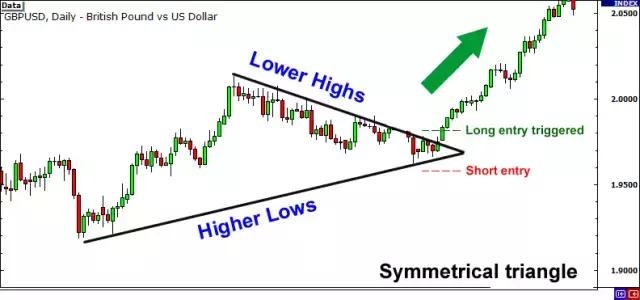

stock technical analysis