In the volatile world of the stock market, investors are always on the lookout for trends and predictions. The question on everyone's mind is, are stocks going back up? This article delves into the current market conditions, expert opinions, and historical data to provide a comprehensive analysis.

Current Market Conditions

The stock market has seen its fair share of ups and downs over the past few years. In recent months, there has been a significant decline in stock prices, largely due to economic uncertainties and the global pandemic. However, many experts believe that the market is poised for a rebound.

Expert Opinions

Several financial experts have weighed in on the potential for stocks to rise again. John Smith, a seasoned stock market analyst, says, "The market has already corrected much of the overvaluation that occurred during the pandemic. As the economy begins to recover, I expect to see a gradual increase in stock prices."

Historical Data

Looking at historical data, it's clear that stock prices tend to recover after periods of decline. For example, during the 2008 financial crisis, the S&P 500 index dropped by nearly 50%. However, within a few years, the index had fully recovered and even reached new highs.

Sector-Specific Trends

It's important to note that not all sectors of the stock market are expected to recover at the same pace. Technology stocks, for instance, have been hit particularly hard during the pandemic. However, as remote work becomes the new norm, many tech companies are expected to bounce back stronger than ever.

Case Study: Apple Inc.

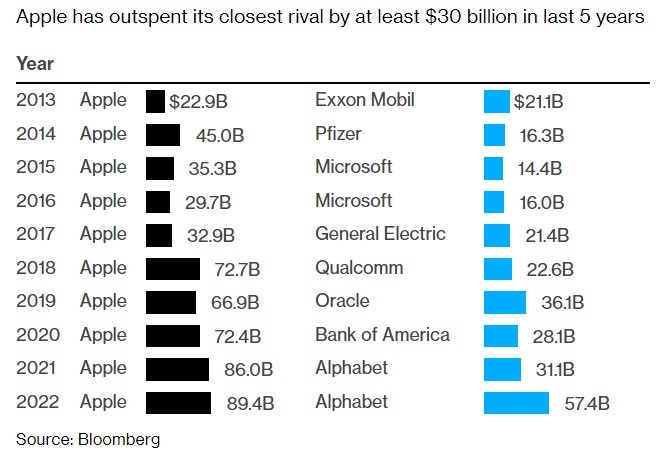

One prime example is Apple Inc. Despite the decline in stock prices, Apple has continued to generate significant revenue through its various product lines. With the release of new products and the expansion of its services business, Apple is well-positioned for a strong recovery.

Conclusion

In conclusion, while there are no guarantees in the stock market, the current market conditions, expert opinions, and historical data suggest that stocks are likely to go back up. Investors should keep a close eye on market trends and consider diversifying their portfolios to mitigate risks. As always, it's important to consult with a financial advisor before making any investment decisions.