In the ever-fluctuating world of finance, the term "markets plummeting" has become a common occurrence. This article delves into the reasons behind market crashes, their impacts, and the strategies employed to recover from such turbulent times. From economic downturns to unforeseen events, understanding these factors is crucial for investors and businesses alike.

The Causes of Market Plunges

1. Economic Downturns One of the primary reasons for market plunges is economic downturns. Factors such as high unemployment rates, decreased consumer spending, and rising inflation can lead to a decline in stock prices. For instance, the 2008 financial crisis was primarily caused by the housing market collapse, which led to a ripple effect across the global economy.

2. Political Instability Political instability can also trigger market crashes. Events such as elections, policy changes, or conflicts can create uncertainty, causing investors to sell off their stocks en masse. The 2016 Brexit vote in the UK is a prime example, where the market experienced significant volatility following the vote.

3. Geopolitical Events

The Impacts of Market Plunges

Market plunges can have several negative impacts on the economy and individuals.

1. Loss of Wealth Investors and individuals who have invested in the stock market can experience significant losses. This can lead to a decrease in their net worth and financial security.

2. Increased Borrowing Costs As markets plummet, interest rates tend to rise. This can make borrowing more expensive for individuals and businesses, leading to a decrease in investment and consumption.

3. Reduced Consumer Confidence Market crashes can lead to a decrease in consumer confidence, as people become more cautious about spending and investing. This can further exacerbate the economic downturn.

Recovery Strategies

Despite the negative impacts, there are strategies that can help mitigate the effects of market plunges.

1. Diversification Diversifying one's investment portfolio can help reduce the risk of significant losses. By investing in a variety of assets, such as stocks, bonds, and real estate, investors can spread out their risk.

2. Long-Term Investing Investing for the long term can help mitigate the impact of short-term market fluctuations. Historically, markets have tended to recover over time, so maintaining a long-term perspective can be beneficial.

3. Government Intervention Governments can also play a role in stabilizing the market. This can include measures such as monetary stimulus, tax cuts, and infrastructure spending.

Case Study: The 2020 COVID-19 Pandemic

The COVID-19 pandemic is a recent example of a market plunge caused by an unforeseen event. The pandemic led to widespread lockdowns, resulting in a significant decline in economic activity. However, the market has since recovered, with many sectors bouncing back stronger than before.

In conclusion, markets plummeting can have significant impacts on the economy and individuals. Understanding the causes, impacts, and recovery strategies can help investors and businesses navigate through these turbulent times. By diversifying their portfolios, investing for the long term, and staying informed about market trends, individuals can mitigate the risks associated with market crashes.

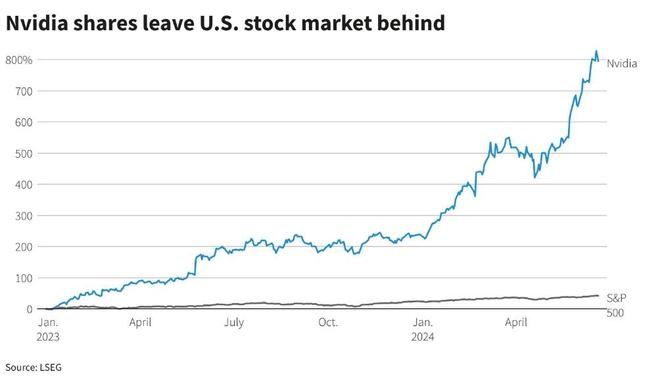

US stock market