In the ever-evolving world of financial markets, the futures market stands as a critical component for investors looking to hedge risks or speculate on future price movements. This article delves into the intricacies of today's futures market, exploring its key features, benefits, and risks.

Understanding Futures Contracts

At its core, a futures contract is a legally binding agreement to buy or sell an asset at a predetermined price and date in the future. These contracts are standardized, traded on exchanges, and are typically for physical commodities like oil, gold, or agricultural products, as well as financial instruments like stocks, bonds, and currencies.

Benefits of the Futures Market

- Hedging Risks: The primary purpose of the futures market is to hedge against price fluctuations. For example, a farmer might sell futures contracts to lock in a price for their crops, ensuring they receive a predetermined amount regardless of the market's direction.

- Speculation: Investors also use the futures market to speculate on future price movements. By taking a position on the market, they can profit from rising or falling prices.

- Liquidity: The futures market offers high liquidity, allowing investors to enter and exit positions quickly and efficiently.

- Standardization: Standardized contracts make it easier for buyers and sellers to trade, as the terms and conditions are pre-defined.

Key Features of Today's Futures Market

- Exchanges: The majority of futures trading occurs on exchanges like the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Chicago Board of Trade (CBOT).

- Regulation: The Commodity Futures Trading Commission (CFTC) regulates the futures market, ensuring fair and transparent trading practices.

- Technology: Advanced trading platforms and algorithms have revolutionized the futures market, allowing for faster and more efficient trading.

- Global Reach: The futures market is a global marketplace, with traders from around the world participating in the various markets.

Case Study: Oil Futures

One of the most prominent examples of the futures market is oil. Oil futures contracts allow producers and consumers to hedge against price volatility. During the 1970s, OPEC's control over oil prices caused significant volatility in the market. As a result, many oil companies turned to futures contracts to protect themselves from potential losses.

Risks and Challenges

Despite its benefits, the futures market also presents significant risks and challenges. These include:

- Volatility: Futures prices can be highly volatile, leading to substantial gains or losses.

- Leverage: The use of leverage can amplify gains but also increase the risk of substantial losses.

- Complexity: Understanding the intricacies of futures contracts can be challenging, especially for novice investors.

- Market Manipulation: There is always a risk of market manipulation, although regulatory bodies like the CFTC work to prevent it.

In conclusion, today's futures market offers numerous opportunities for investors, but it also requires careful consideration of the associated risks. By understanding the key features and benefits of the market, investors can make informed decisions and potentially profit from this dynamic and exciting marketplace.

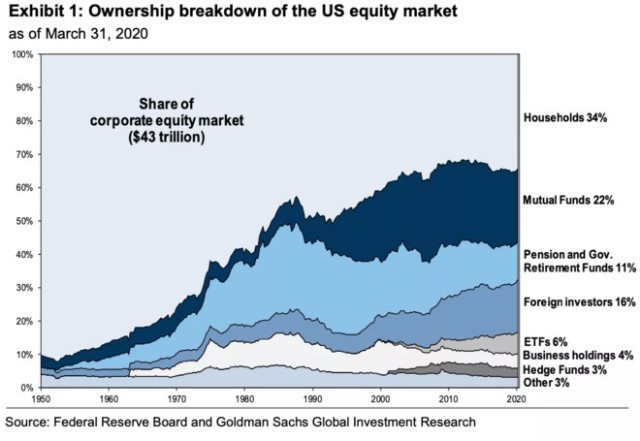

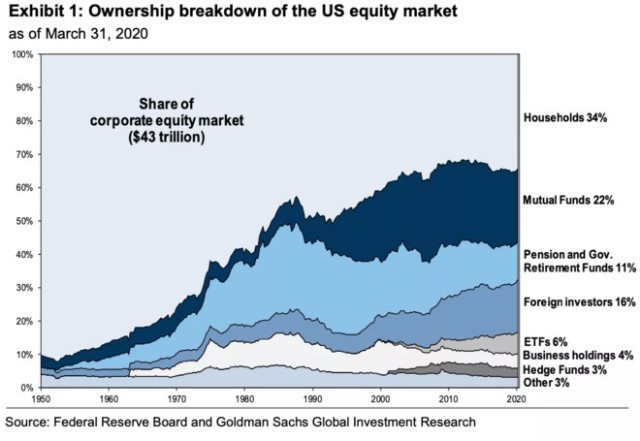

US stocks companies