Are U.S. stocks poised for a comeback or is this the beginning of a more extended downturn? As investors grapple with the ever-changing landscape of the stock market, one burning question looms large: Have U.S. stocks bottomed? Let's delve into the latest signs and analyses to get a clearer picture.

Understanding the Market's Pulse

Firstly, it's essential to understand that predicting stock market bottoms is inherently challenging. The market is influenced by numerous factors, including economic indicators, political events, and corporate earnings reports. However, several key signs can provide valuable insights.

1. Market Valuations

One of the most crucial indicators is market valuations. Historically, low market valuations often precede market bottoms. According to data from Morningstar, the S&P 500 is currently trading at a forward price-to-earnings (P/E) ratio of around 18.5, which is below its long-term average of 21.2. This suggests that stocks may be undervalued and, consequently, could be nearing a bottom.

2. Margin Debt

Another important indicator is margin debt. Margin debt refers to the amount of money borrowed by investors to purchase stocks. When margin debt levels are low, it often indicates that investors are cautious and less likely to drive the market higher. According to the American Bankers Association, margin debt as a percentage of total stock market value stands at 1.84%, which is relatively low compared to its peak of 3.46% in 2007.

3. Earnings Reports

Earnings reports from corporations also play a vital role in determining the market's direction. Many companies have reported strong earnings, with some sectors outperforming others. For instance, the Information Technology sector has seen robust earnings growth, with several major players like Apple and Microsoft exceeding expectations. This suggests that the market's fundamental strength may be more resilient than perceived.

Case Study: The 2009 Financial Crisis

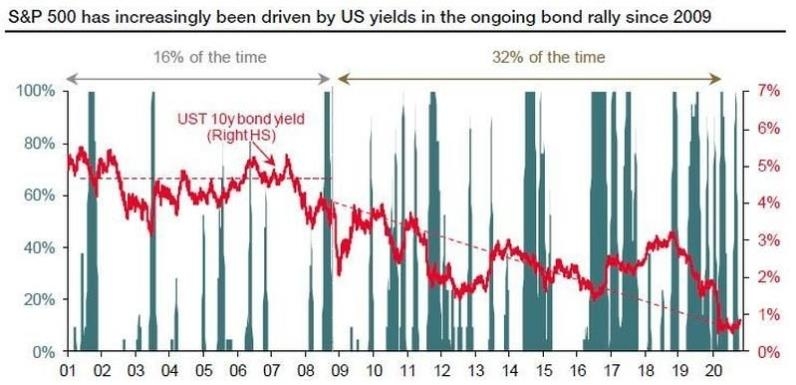

To better understand the market's behavior, let's take a look at a historical example. During the 2008-2009 financial crisis, the S&P 500 plummeted by nearly 50%. However, the market bottomed out in March 2009, and it took only a few years for stocks to recover and surpass their pre-crisis levels. This example highlights the market's ability to rebound from severe downturns.

What Should Investors Do?

Given the current market conditions, investors may want to consider the following strategies:

Conclusion

While predicting market bottoms is never easy, several signs indicate that U.S. stocks may be nearing a bottom. As investors, it's crucial to stay informed and consider a range of factors before making investment decisions. As always, it's advisable to consult with a financial advisor before making significant investment moves.