The stock market has always been a volatile place, and recent trends have only amplified this. Understanding the current state of the market is crucial for investors and traders alike. In this article, we'll delve into the key factors shaping the stock market today and explore the potential implications for the future.

Market Performance

The stock market has seen a rollercoaster of a ride lately. As of [insert current date], the S&P 500 has experienced significant fluctuations, with some sectors faring better than others. Technology stocks, particularly those in the FAANG (Facebook, Apple, Amazon, Netflix, and Google) group, have been among the top performers. Conversely, energy stocks have struggled due to the global oil glut and concerns about oversupply.

Inflation and Interest Rates

One of the biggest concerns affecting the stock market is inflation. The Consumer Price Index (CPI) has been on the rise, leading to fears of higher interest rates from the Federal Reserve. This has created a dilemma for investors, as higher rates can dampen economic growth and negatively impact stock prices. However, some analysts believe that the Fed's cautious approach will help mitigate the impact of inflation.

Geopolitical Tensions

Geopolitical tensions have also played a significant role in the current state of the stock market. The ongoing trade war between the United States and China has caused uncertainty and volatility. Additionally, the conflict in Eastern Europe has raised concerns about global stability and its potential impact on the economy.

Impact on Investors

The current state of the stock market has had a significant impact on investors. Retail investors have been particularly active, with many taking advantage of the volatility to buy low and sell high. On the other hand, institutional investors have been more cautious, with many choosing to hold off on making significant investments until the market stabilizes.

Case Studies

One notable case study is the Tesla (TSLA) stock, which has seen significant volatility in recent months. Despite the company's impressive growth and innovative technology, concerns about manufacturing delays and government regulations have caused the stock to fluctuate wildly.

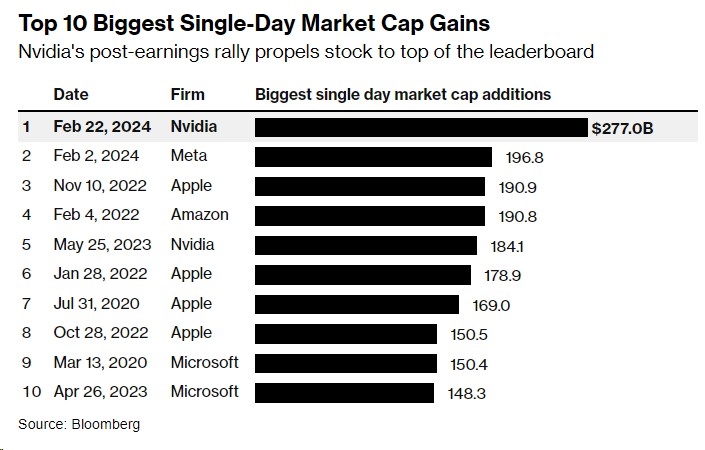

Another example is the NVIDIA (NVDA) stock, which has been a top performer in the technology sector. The company's strong performance has been driven by the increasing demand for graphical processing units (GPUs) in the cryptocurrency mining and artificial intelligence markets.

Conclusion

The stock market is currently experiencing a complex mix of factors that are driving volatility and uncertainty. Investors need to stay informed and be prepared for potential challenges ahead. By understanding the key drivers of the market and keeping a close eye on the latest developments, investors can make more informed decisions and navigate the current landscape with confidence.

stock technical analysis