In recent market developments, the US dollar has experienced a significant surge, coinciding with a drop in stock prices. This article delves into the reasons behind this correlation and what it could mean for investors.

Understanding the Correlation

The relationship between the US dollar and stock markets is often complex but can be understood through several key factors. When stocks drop, investors often seek the safety of the US dollar, which is considered a "safe haven" currency. This is because the US dollar is the world's primary reserve currency and is often seen as a stable investment during times of market uncertainty.

Reasons for the Stock Market Drop

Several factors have contributed to the recent drop in stock prices. These include:

The Impact on the US Dollar

As investors seek the safety of the US dollar, its value tends to increase. This is because the demand for the currency rises, making it more expensive relative to other currencies.

What It Means for Investors

For investors, understanding the correlation between the US dollar and stock markets is crucial. Here are some key takeaways:

Case Study: The 2008 Financial Crisis

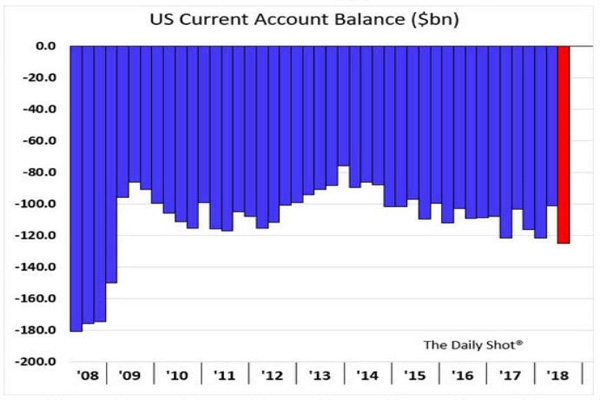

A notable example of the correlation between the US dollar and stock markets is the 2008 financial crisis. During this period, the US dollar surged as stock prices plummeted. Investors sought the safety of the US dollar, leading to its appreciation. This demonstrates how the correlation can play out in real-world market conditions.

In conclusion, the recent surge in the US dollar and the drop in stock prices highlight the complex relationship between these two financial markets. Understanding this correlation and its implications can help investors make informed decisions and navigate market volatility.

stock technical analysis