Understanding the Potential Impact

The recent tensions in Israel have raised concerns about their potential impact on the U.S. stock market. As investors, it's crucial to understand how geopolitical events can influence market dynamics. This article delves into the possible effects of the ongoing conflict on the U.S. stock market, providing insights into the risks and opportunities it presents.

Geopolitical Risk and Market Volatility

The conflict in Israel has the potential to escalate, leading to increased geopolitical risk. This risk can manifest in various ways, including:

- Increased Oil Prices: The Middle East is a major oil-producing region, and any disruption in oil supplies can lead to higher prices. This, in turn, can impact the U.S. stock market, particularly sectors like energy and transportation.

- Currency Fluctuations: The value of the U.S. dollar can be affected by geopolitical events. A weaker dollar can make U.S. exports more expensive and reduce the purchasing power of American consumers, potentially impacting the stock market.

- Economic Sanctions: The U.S. and its allies may impose economic sanctions on Israel's adversaries, which can lead to supply chain disruptions and higher inflation.

Sector-Specific Impacts

Several sectors are likely to be affected by the ongoing conflict:

- Energy Sector: As mentioned earlier, increased oil prices can negatively impact the energy sector. However, some energy companies may benefit from higher oil prices and increased demand for energy.

- Defense Sector: The defense sector is expected to benefit from increased spending on national security. Companies involved in defense and aerospace may see a boost in their stock prices.

- Technology Sector: The technology sector may be less directly affected by the conflict. However, companies with significant operations in the Middle East may face disruptions and increased costs.

Case Study: The 2020 Israel-Gaza Conflict

A similar conflict in 2020 provided valuable insights into the potential impact of geopolitical events on the U.S. stock market. During this period, the S&P 500 experienced significant volatility, with the index falling by nearly 10% in the weeks following the conflict's escalation. However, the market eventually recovered, with the S&P 500 ending the year with a positive return.

Investment Strategies

Given the potential risks and opportunities presented by the ongoing conflict in Israel, investors should consider the following strategies:

- Diversification: Diversifying your portfolio can help mitigate the impact of geopolitical events. Consider investing in sectors that may benefit from increased defense spending or higher oil prices.

- Risk Management: Implement risk management techniques, such as stop-loss orders, to protect your investments from significant losses.

- Stay Informed: Keep up-to-date with the latest news and developments related to the conflict in Israel. This will help you make informed investment decisions.

Conclusion

The ongoing conflict in Israel presents potential risks and opportunities for the U.S. stock market. While it's impossible to predict the exact impact of the conflict, understanding the potential effects can help investors make informed decisions. By diversifying your portfolio, managing risk, and staying informed, you can navigate the challenges and opportunities presented by geopolitical events.

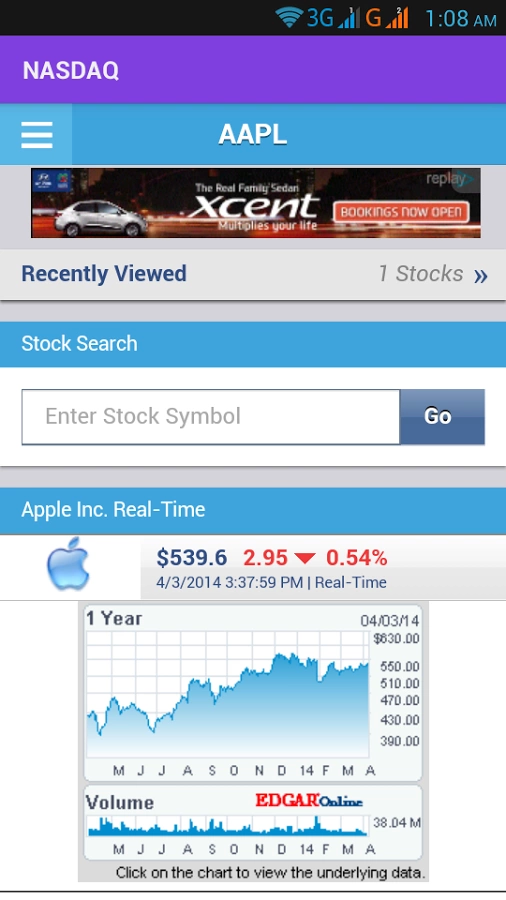

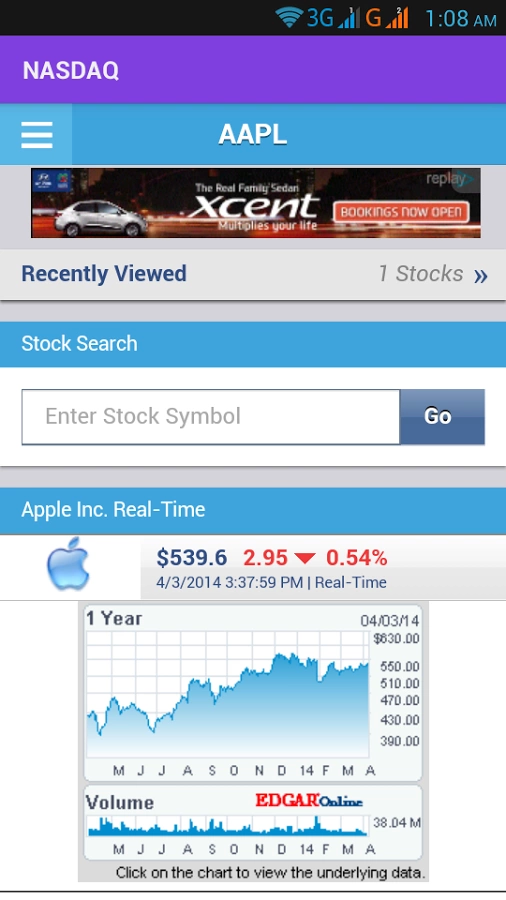

stock technical analysis