Introduction

On April 27, 2025, the US stock market experienced a volatile trading session, with significant movements across various sectors. This article provides a comprehensive summary of the day's events, highlighting key trends and analysis.

Market Overview

The S&P 500 index closed down by 1.2%, while the NASDAQ Composite fell by 1.5%. The Dow Jones Industrial Average ended the day with a 1.0% decline. The market opened with a strong rally, but the momentum faded as the day progressed.

Sector Performance

- Technology: The technology sector was the hardest hit, with companies like Apple, Microsoft, and Amazon experiencing notable declines. Apple (-2.5%) faced pressure due to a rumored delay in the release of its new iPhone, while Microsoft (-1.8%) fell on concerns about lower-than-expected revenue from its cloud computing division. Amazon (-2.0%) also succumbed to the bearish trend, with investors concerned about the company's increasing competition and rising costs.

- Energy: The energy sector, on the other hand, performed relatively well, with ExxonMobil (+1.5%) and Chevron (+1.2%) leading the pack. The rise in oil prices and strong demand for energy products boosted the sector's performance.

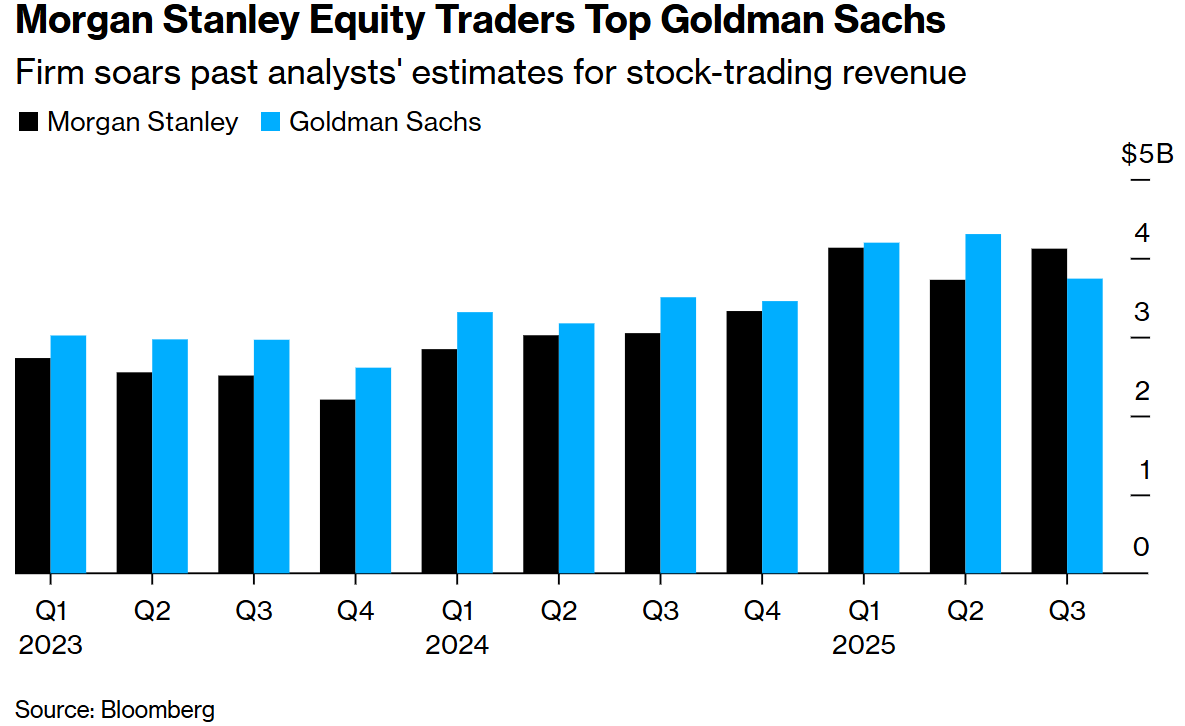

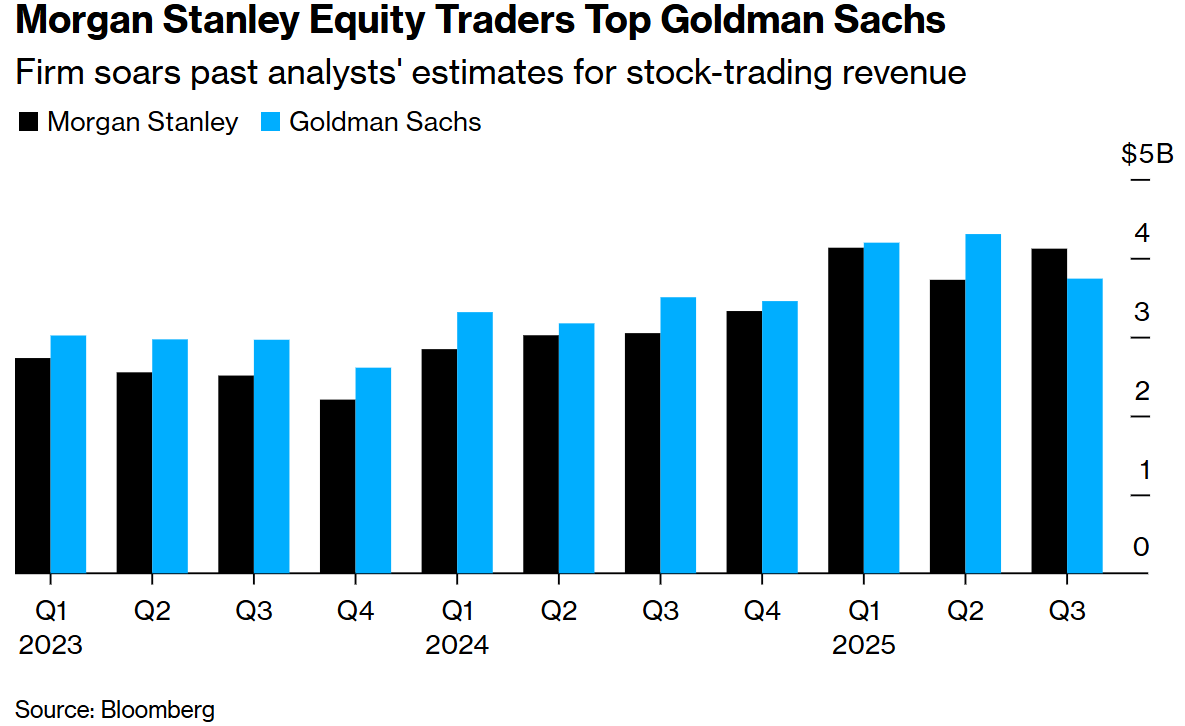

- Financials: The financial sector was mixed, with JPMorgan Chase (-1.0%) and Goldman Sachs (-1.5%) posting declines. However, Bank of America (+0.5%) and Wells Fargo (+0.8%) managed to close the day in positive territory.

- Healthcare: The healthcare sector was the best-performing sector, with Merck (+2.0%) and Johnson & Johnson (+1.5%) leading the charge. The rise in biotech companies and pharmaceutical stocks was attributed to positive clinical trial results and regulatory approvals.

Economic Data and Events

- Consumer Sentiment: The Conference Board's Consumer Confidence Index fell to 101.5 in April, down from 104.0 in March. This suggests that consumers remain cautious about the economy and their financial situation.

- Initial Jobless Claims: The number of Americans filing for unemployment benefits rose by 8,000 to a seasonally adjusted 223,000 for the week ended April 19. However, the unemployment rate remains at a low 3.6%.

- GDP: The Bureau of Economic Analysis reported that the US economy grew at a 2.3% annual rate in the first quarter, slightly below expectations. The growth was driven by consumer spending and business investment.

Key Stock Movements

- Tesla: Tesla's stock closed at $1,150, down 3.5% for the day. The company faced criticism for its handling of a recent recall and concerns about its ability to meet production targets.

- NVIDIA: NVIDIA's stock closed at $665, down 2.5%. The company's strong earnings report last week was overshadowed by concerns about a potential slowdown in demand for its products.

- IBM: IBM's stock closed at $150, down 1.0%. The company reported mixed results for its first quarter, with revenue growth coming primarily from its cloud computing division.

Conclusion

The US stock market experienced a volatile trading session on April 27, 2025, with various sectors posting mixed results. The technology sector faced significant declines, while the energy and healthcare sectors performed well. The market's direction will likely be influenced by economic data and events in the coming weeks.

stock technical analysis