Introduction

In the fast-paced world of finance, today's stock market trends can significantly impact investors' portfolios. With the recent surge in market activity, it's essential to understand the factors driving this upward trend. This article delves into the key drivers behind today's "stocks up" scenario, providing valuable insights for investors looking to capitalize on this momentum.

Key Factors Contributing to Today's Stock Market Uptrend

Economic Growth and Stability

- Strong GDP Growth: The U.S. economy has experienced robust GDP growth in recent quarters, fueling investor confidence and driving stock prices higher.

- Low Inflation: With inflation remaining relatively low, the Federal Reserve has maintained a accommodative monetary policy, further supporting stock market growth.

Corporate Earnings

- Record Profits: Many companies have reported record profits, driven by strong revenue growth and cost-cutting measures.

- Earnings Season: The upcoming earnings season is expected to showcase strong corporate performance, potentially boosting stock prices further.

Technological Advancements

- Innovation: Technological advancements have revolutionized various industries, leading to increased productivity and profitability.

- Sector Performance: Tech stocks, in particular, have been a major driver of today's market upswing.

Global Economic Conditions

- Emerging Markets: The economic growth in emerging markets has contributed to a positive global economic environment, benefiting multinational corporations.

- Trade Agreements: The recent trade agreements have reduced trade tensions, supporting global economic stability.

Investor Sentiment

- Optimism: The overall investor sentiment remains optimistic, driven by positive economic indicators and strong corporate earnings.

- Risk Appetite: Investors have shown a higher risk appetite, leading to increased investment in higher-risk assets like stocks.

Case Studies

Tech Giant Apple

- Apple's strong quarterly earnings report, driven by robust iPhone sales and services revenue, has significantly contributed to the overall market upswing.

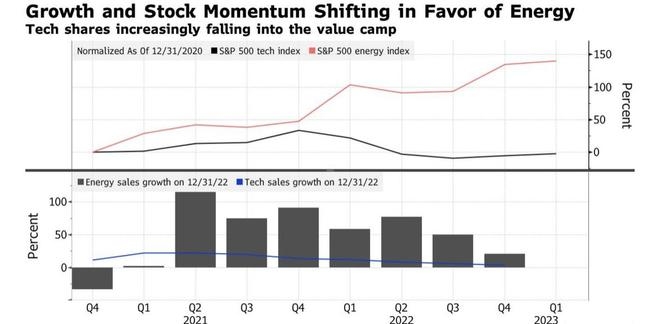

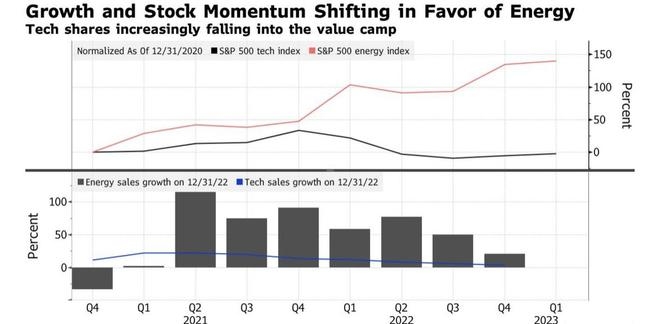

Energy Sector

- The energy sector has seen a significant recovery, driven by increased oil prices and strong demand for energy products.

Conclusion

Today's "stocks up" scenario is a result of a combination of favorable economic conditions, strong corporate earnings, and positive investor sentiment. As an investor, it's crucial to stay informed about these trends and make informed decisions to capitalize on this momentum. By understanding the key factors driving today's market trends, investors can make more informed decisions and potentially enhance their investment portfolios.

stock investment strategies