In today's fast-paced financial world, understanding the value of the US stock market is crucial for investors and traders alike. The stock market is a reflection of the economic health and growth potential of a country, and the US stock market, in particular, is often considered a benchmark for global financial markets. This article delves into the various aspects that determine the value of the US stock market, providing a comprehensive guide for those looking to navigate this complex landscape.

Understanding Market Capitalization

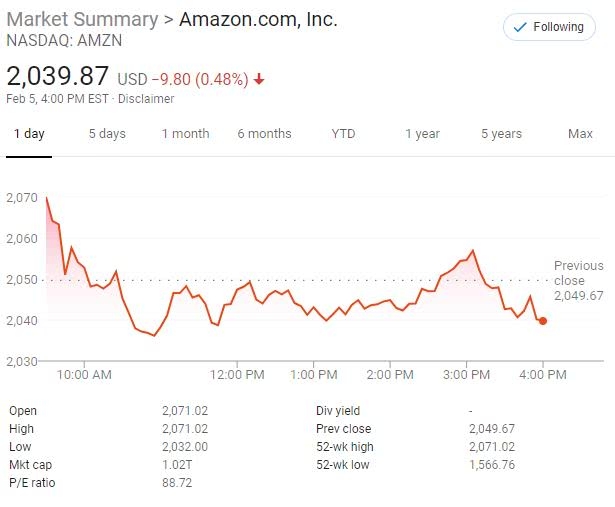

One of the primary ways to measure the value of the US stock market is through market capitalization. Market capitalization, often referred to as "market cap," is the total value of all the shares of a company. It is calculated by multiplying the number of outstanding shares by the current market price of the stock.

For example, if a company has 100 million outstanding shares and each share is trading at

The Role of Indices

Indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, play a crucial role in gauging the overall value of the US stock market. These indices are composed of a basket of stocks that represent a broad range of industries and sectors. By tracking the performance of these indices, investors can get a snapshot of the market's health.

The S&P 500, for instance, is a widely followed index that includes the top 500 companies listed on the New York Stock Exchange and NASDAQ. It is often used as a benchmark for the US stock market's performance.

Economic Indicators and Market Value

Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly impact the value of the US stock market. A strong economy with low unemployment and stable inflation tends to drive up stock prices, while a weak economy with high unemployment and rising inflation can lead to a decline in market value.

For instance, during the COVID-19 pandemic, the US stock market experienced a significant downturn due to economic uncertainty. However, as the economy began to recover, the market value started to stabilize and even rise.

Sector Performance and Market Value

The performance of different sectors within the US stock market can also influence its overall value. Sectors such as technology, healthcare, and financials have historically shown strong growth, contributing to the market's overall value.

For example, the tech sector has been a major driver of the US stock market's growth over the past few years, with companies like Apple and Microsoft leading the charge. By understanding the performance of these sectors, investors can gain insights into the market's potential for future growth.

Historical Performance and Market Value

Historical performance is another important factor to consider when evaluating the value of the US stock market. Over the long term, the stock market has shown a positive trend, with periodic ups and downs. By analyzing historical data, investors can gain a better understanding of the market's potential for future growth.

For instance, the US stock market has experienced several bull markets over the past century, with the most recent bull market, which began in 2009, lasting until early 2020. Understanding these historical trends can help investors make informed decisions.

Conclusion

In conclusion, the value of the US stock market is influenced by a variety of factors, including market capitalization, indices, economic indicators, sector performance, and historical data. By understanding these factors, investors can gain a clearer picture of the market's potential for growth and make more informed investment decisions. Whether you are a seasoned investor or just starting out, it is crucial to stay informed and stay educated about the US stock market to navigate this dynamic landscape successfully.

stock investment strategies