In today's dynamic financial landscape, investors are always on the lookout for reliable investment options that offer both stability and growth potential. One such investment vehicle that has stood the test of time is the 10-Year US Treasury Stock. This guide will delve into what it is, how it works, and why it remains a preferred choice for many investors.

Understanding 10-Year US Treasury Stocks

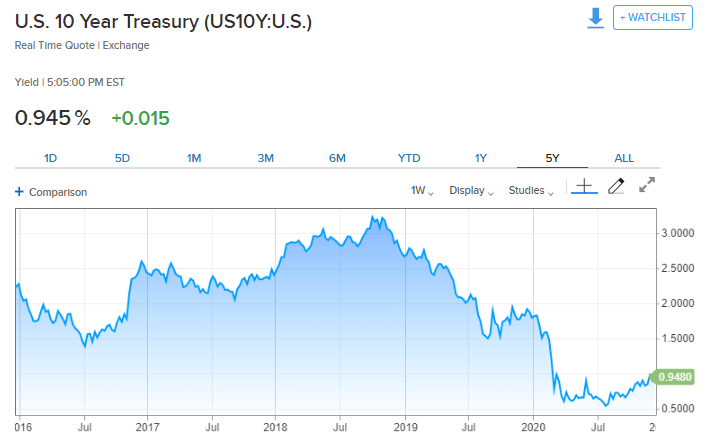

A 10-Year US Treasury Stock, often referred to as a "note," is a debt security issued by the United States Department of the Treasury to finance government spending. These notes have a maturity of ten years and pay interest twice a year. The interest rate is determined at the time of issuance and remains fixed throughout the life of the security.

These securities are considered one of the safest investments in the world, primarily due to the backing of the US government. This means that the risk of default is virtually non-existent, making 10-Year US Treasury Stocks a popular choice for risk-averse investors and those nearing retirement.

Investment Benefits of 10-Year US Treasury Stocks

Stability: The fixed interest payments and the low risk of default make 10-Year US Treasury Stocks an excellent option for those seeking stable income in their investment portfolio.

Diversification: Including 10-Year US Treasury Stocks in a diversified investment portfolio can help reduce overall risk, as these securities tend to perform well during economic downturns.

Tax Advantages: Interest earned from these securities is typically exempt from state and local taxes and is taxed as ordinary income at the federal level.

Inflation-Linked: Some 10-Year US Treasury Stocks are indexed to inflation, providing investors with the potential for increased interest payments to keep pace with rising prices.

How to Invest in 10-Year US Treasury Stocks

Investors can purchase 10-Year US Treasury Stocks directly from the US Treasury or through a broker. The process is straightforward:

Case Study: Investing in 10-Year US Treasury Stocks

Consider the case of John, a risk-averse investor nearing retirement. He decides to invest in 10-Year US Treasury Stocks as part of his retirement portfolio. By doing so, he not only secures a stable income stream but also ensures that his investment is protected from the volatility of the stock market.

Conclusion

10-Year US Treasury Stocks offer a unique combination of stability, safety, and diversification that makes them an appealing investment choice for a wide range of investors. Whether you are looking for a reliable source of income or a way to protect your investment portfolio, these securities are definitely worth considering.

stock investment strategies