In recent years, the US banking sector has emerged as a shining beacon of stability and growth amidst a volatile global economy. The impressive win streak of US bank stocks has been a testament to the resilience and adaptability of the financial industry. This article delves into the factors contributing to this remarkable trend and examines the potential implications for investors and the broader economy.

The Resilience of US Bank Stocks

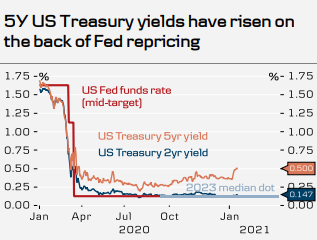

The win streak of US bank stocks can be attributed to several key factors. Firstly, the Federal Reserve's accommodative monetary policy has been a significant driver of this trend. With interest rates at historic lows, banks have been able to borrow cheaply and lend at higher rates, thereby boosting their profitability. This has been particularly beneficial for larger banks with substantial loan portfolios.

Secondly, the strong performance of the US economy has played a crucial role in the rise of bank stocks. The US economy has been growing at a steady pace, leading to increased demand for loans and other financial services. This has translated into higher revenue and earnings for banks, driving up their stock prices.

Case Study: JPMorgan Chase

A prime example of the win streak in US bank stocks is JPMorgan Chase, one of the largest banks in the United States. Over the past five years, JPMorgan Chase has seen its stock price soar by over 50%. This impressive performance can be attributed to the bank's diversified business model, which includes investment banking, retail banking, and asset management. Additionally, JPMorgan Chase has been able to effectively manage risk and navigate the complexities of the financial market, further enhancing its profitability.

Regulatory Environment and Innovation

The regulatory environment has also played a pivotal role in the win streak of US bank stocks. The passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 aimed to prevent another financial crisis by imposing stricter regulations on banks. While these regulations have imposed certain constraints on banks, they have also fostered a more stable and transparent financial system, which has been beneficial for investors.

Moreover, the rapid pace of technological innovation has been a game-changer for the banking industry. Many banks have embraced digital transformation, offering customers convenient online and mobile banking services. This shift has not only improved customer satisfaction but has also opened up new revenue streams for banks.

The Future of US Bank Stocks

Looking ahead, the win streak of US bank stocks is expected to continue, albeit with some challenges. The Federal Reserve's decision to raise interest rates in response to inflationary pressures could potentially slow down the growth momentum. However, the strong fundamentals of the US economy and the resilience of the banking sector suggest that the win streak is likely to persist.

In conclusion, the win streak of US bank stocks is a testament to the industry's adaptability and resilience. As long as the US economy remains robust and the regulatory environment remains favorable, investors can expect the trend to continue. However, it is crucial for investors to remain vigilant and stay informed about the evolving market conditions.

stock investment strategies