In the ever-evolving world of finance, understanding the various stock sectors is crucial for investors looking to diversify their portfolios. The U.S. stock market is a vast landscape, encompassing a wide array of sectors, each with its unique characteristics and potential for growth. This article delves into the key U.S. stock sectors, providing an in-depth analysis to help investors navigate the market effectively.

1. Technology (Tech) Sector

The technology sector is often considered one of the most dynamic and influential in the U.S. stock market. It includes companies involved in the development, manufacturing, and distribution of technology products and services. Key players in this sector include Apple, Microsoft, and Google's parent company, Alphabet. The tech sector is known for its rapid innovation and high growth potential, but it also comes with volatile market fluctuations.

2. Healthcare Sector

The healthcare sector is a vital component of the U.S. stock market, driven by the aging population and advancements in medical technology. This sector encompasses pharmaceutical companies, biotech firms, medical device manufacturers, and healthcare providers. Notable companies in this sector include Johnson & Johnson, Pfizer, and Amgen. The healthcare sector offers stability and long-term growth prospects, as the demand for medical products and services is expected to increase over time.

3. Financial Sector

The financial sector is another critical area of the U.S. stock market, involving companies that provide financial services such as banking, insurance, and investment management. Major players in this sector include JPMorgan Chase, Wells Fargo, and Bank of America. The financial sector can be volatile due to economic conditions and regulatory changes, but it also offers significant potential for growth and high returns.

4. Energy Sector

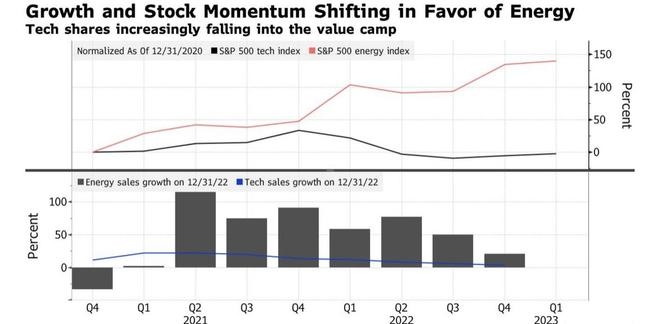

The energy sector includes companies involved in the exploration, production, and distribution of oil, natural gas, and coal. This sector has seen significant changes in recent years, with the rise of renewable energy sources. Notable companies in this sector include ExxonMobil, Chevron, and Occidental Petroleum. The energy sector is subject to market volatility and geopolitical risks, but it also offers potential for substantial returns.

5. Consumer Discretionary Sector

The consumer discretionary sector encompasses companies that produce goods and services that are not considered essential, such as luxury goods, entertainment, and leisure. This sector includes companies like Disney, Visa, and Amazon. The consumer discretionary sector is sensitive to economic cycles and consumer spending patterns, making it a volatile but potentially high-growth area.

6. Consumer Staples Sector

The consumer staples sector includes companies that produce goods and services that are considered essential, such as food, beverages, and household products. Companies like Procter & Gamble, Coca-Cola, and Walmart are key players in this sector. The consumer staples sector is known for its stability and resilience during economic downturns, making it an attractive investment for conservative investors.

7. Industrial Sector

The industrial sector includes companies involved in the manufacturing and construction of goods and services. This sector encompasses a wide range of businesses, from aerospace and defense to construction and engineering. Key players in this sector include General Electric, 3M, and Caterpillar. The industrial sector can be volatile due to economic cycles, but it also offers potential for growth and innovation.

8. Real Estate Sector

The real estate sector includes companies involved in the development, management, and financing of real estate properties. This sector includes REITs (Real Estate Investment Trusts) and other real estate-related companies. Notable companies in this sector include万科企业、中国海外发展和铁建国际。 The real estate sector offers diversification and potential for income generation, but it can also be volatile due to market conditions.

9. Utilities Sector

The utilities sector includes companies involved in the generation, transmission, and distribution of electricity, natural gas, and water. This sector is known for its 稳定性 and predictable cash flows. Key players in this sector include Duke Energy, Southern Company, and Exelon. The utilities sector is often considered a safe investment, particularly for conservative investors seeking stable returns.

Understanding the various U.S. stock sectors is essential for investors looking to build a well-diversified portfolio. Each sector offers unique opportunities and risks, and it's important to consider your investment goals and risk tolerance when selecting stocks. By familiarizing yourself with the key sectors and their characteristics, you can make informed decisions and potentially achieve long-term success in the stock market.

stock investment strategies