In today's fast-paced digital world, the financial industry is constantly evolving. One company that has been making waves is Yhoofinance. This innovative platform is revolutionizing the way people manage their finances, offering a seamless and user-friendly experience. In this article, we will delve into the features, benefits, and impact of Yhoofinance on the financial industry.

Understanding Yhoofinance

Yhoofinance is a comprehensive financial management platform designed to cater to the needs of individuals and businesses alike. It offers a wide range of services, including budgeting, investment tracking, and financial planning. The platform is built on a robust algorithm that provides personalized recommendations based on the user's financial goals and risk tolerance.

Key Features of Yhoofinance

One of the standout features of Yhoofinance is its intuitive user interface. The platform is designed to be easy to navigate, even for those who are not tech-savvy. Users can quickly access their financial information, track their investments, and set up automated savings plans.

Another key feature is the platform's advanced analytics capabilities. Yhoofinance provides users with detailed insights into their financial health, allowing them to make informed decisions. The platform also offers real-time alerts, ensuring that users are always up-to-date with their financial activities.

Benefits of Using Yhoofinance

There are several benefits to using Yhoofinance. Firstly, the platform saves users time and effort by consolidating their financial information in one place. This allows them to have a clear overview of their finances, making it easier to manage their money effectively.

Secondly, Yhoofinance helps users make smarter financial decisions. By providing personalized recommendations and insights, the platform empowers users to invest in the right assets and achieve their financial goals.

Lastly, Yhoofinance is a cost-effective solution. The platform offers a range of free tools and services, making it accessible to users of all income levels.

Case Studies

To illustrate the impact of Yhoofinance, let's look at a couple of case studies.

Case Study 1: John, the Freelancer

John is a freelance writer who struggled to manage his finances. He had multiple bank accounts, and it was difficult for him to keep track of his income and expenses. After signing up for Yhoofinance, John was able to consolidate his accounts and set up automated bill payments. The platform also provided him with personalized investment recommendations, allowing him to grow his savings.

Case Study 2: Sarah, the Small Business Owner

Sarah owns a small retail business and found it challenging to manage her finances. Yhoofinance helped her streamline her accounting process, track her inventory, and set up a budget. The platform's analytics capabilities allowed her to identify areas where she could cut costs and increase her profits.

Conclusion

Yhoofinance is a game-changer in the financial industry. Its user-friendly interface, advanced analytics, and personalized recommendations make it an invaluable tool for individuals and businesses alike. As the financial landscape continues to evolve, Yhoofinance is poised to play a significant role in shaping the future of finance.

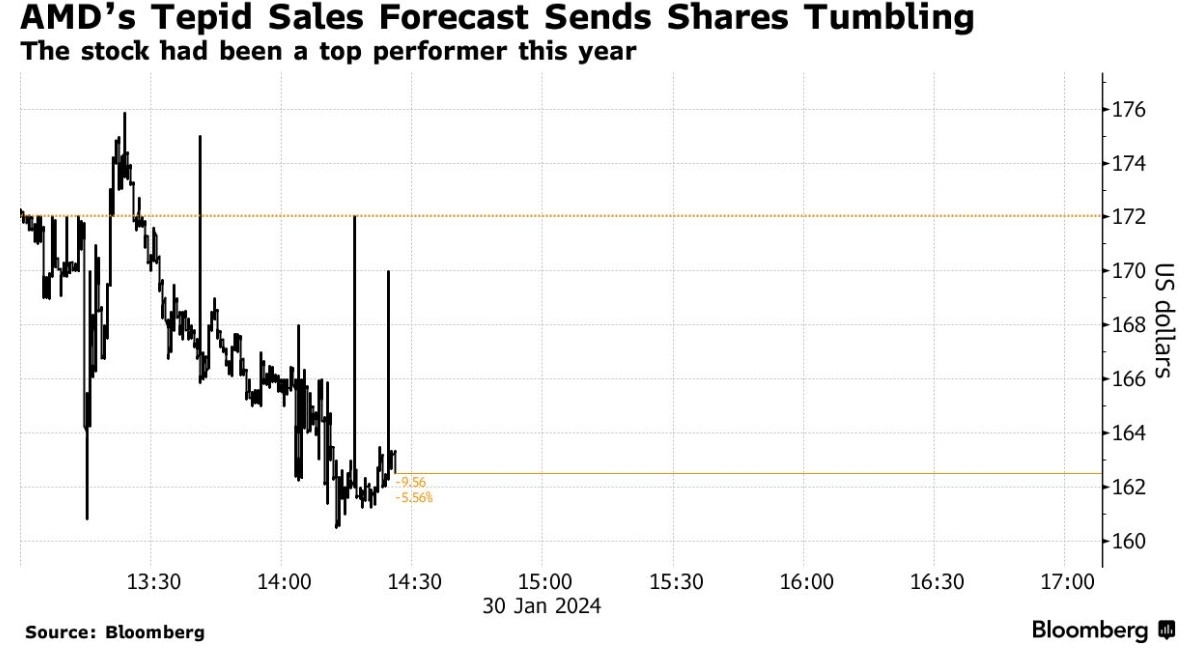

US stock market