The US election is a pivotal event that can significantly impact the stock markets. As the nation awaits the final results, investors are closely monitoring potential shifts in policies and market trends. This article delves into the key insights and predictions for the stock markets following the election.

Historical Stock Market Trends

Historically, stock markets have shown varying reactions to US elections. Some studies suggest that the stock market tends to perform well under a Republican administration, while others indicate that a Democratic administration can lead to favorable market conditions. However, it is essential to note that these trends are not absolute and can be influenced by various factors.

Key Issues Affecting the Stock Markets

Several key issues are likely to influence the stock markets following the election:

Tax Policies: Changes in tax policies can have a significant impact on corporate earnings and consumer spending. A reduction in corporate tax rates can boost earnings, while changes in individual tax rates can affect consumer spending.

Trade Policies: The election outcome may also impact trade policies, which can influence global supply chains and the US dollar. A more protectionist stance could lead to higher tariffs and trade tensions, while a more open approach could promote global trade and investment.

Regulatory Policies: Regulatory policies, particularly in the financial sector, can also impact the stock markets. A more stringent regulatory environment could lead to increased compliance costs for companies, while a more lenient approach could boost profitability.

Economic Stimulus Measures: The election outcome may also influence economic stimulus measures, such as infrastructure spending and healthcare reform. These measures can have a significant impact on economic growth and corporate earnings.

Predictions for the Stock Markets

Several experts have offered predictions for the stock markets following the election:

Bullish Outlook: Some experts predict that the stock markets will continue to perform well following the election, driven by factors such as low interest rates, strong economic growth, and corporate earnings.

Bearish Outlook: Others predict that the stock markets may experience volatility or even a downturn following the election, driven by factors such as policy uncertainty, trade tensions, and regulatory changes.

Case Studies

To illustrate the potential impact of the election on the stock markets, let's consider two case studies:

2008 US Election: The 2008 election saw a Democratic victory, leading to a period of market volatility and uncertainty. However, the stock markets eventually recovered and reached new highs by the end of 2009.

2016 US Election: The 2016 election resulted in a Republican victory, leading to a strong rally in the stock markets. However, the market experienced significant volatility in the first few months of 2018, driven by concerns about trade policies and regulatory changes.

Conclusion

The US election is a pivotal event that can significantly impact the stock markets. While historical trends and expert predictions can provide insights, it is crucial to recognize that the stock markets are influenced by a wide range of factors. As investors, it is essential to stay informed and adapt to changing market conditions.

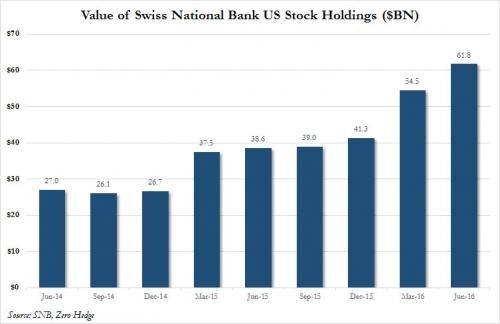

US stock market