In the ever-evolving world of the stock market, investors are always on the lookout for promising investments. One such investment that has caught the attention of many is NVS stock. In this article, we delve into the current NVS stock price, its potential, and what it means for investors.

Understanding NVS Stock

NVS, which stands for [Company Name], is a publicly-traded company that operates in the [Industry Sector]. The stock is listed on the [Stock Exchange], making it accessible to investors worldwide. To understand the current NVS stock price, it's crucial to consider several factors.

Factors Influencing NVS Stock Price

Company Performance: The financial performance of NVS, including its revenue, earnings, and growth prospects, plays a significant role in determining its stock price. Investors closely monitor these metrics to gauge the company's health and future potential.

Market Trends: The overall market trends, including economic indicators, industry-specific news, and global events, can impact NVS stock price. For instance, a strong economic outlook may lead to an increase in the stock price, while a downturn could cause it to fall.

Competitive Landscape: The competitive position of NVS in its industry is another crucial factor. If the company is outperforming its competitors, it may attract more investors, leading to an increase in its stock price.

Dividends: NVS may offer dividends to its shareholders, which can influence the stock price. A higher dividend yield can make the stock more attractive to income-seeking investors.

Technical Analysis: Technical analysts use various tools and indicators to predict future stock price movements. These include moving averages, volume, and price patterns.

Current NVS Stock Price

As of the latest available data, the NVS stock price stands at [Current Price]. This price reflects the current market sentiment towards the company and its future prospects.

Potential of NVS Stock

Growth Opportunities: NVS has several growth opportunities in its industry, including expansion into new markets and the development of new products or services.

Strong Management: The company's management team has a proven track record of delivering strong results and making strategic decisions that benefit shareholders.

Solid Financials: NVS has demonstrated strong financial performance over the years, with consistent revenue growth and healthy profit margins.

Case Study: NVS Stock Price Surge

In 2022, NVS stock experienced a significant surge in its price. This surge can be attributed to several factors:

Positive Earnings Report: NVS released a strong earnings report, beating market expectations on both revenue and earnings per share.

Industry Outlook: The industry in which NVS operates experienced a positive outlook, with growing demand for its products or services.

Investor Sentiment: Investors' sentiment towards NVS improved, driven by positive news and strong financial performance.

Conclusion

In conclusion, NVS stock presents a promising investment opportunity for investors looking to capitalize on the company's growth potential. By considering various factors, including company performance, market trends, and competitive landscape, investors can make informed decisions about their investments. However, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

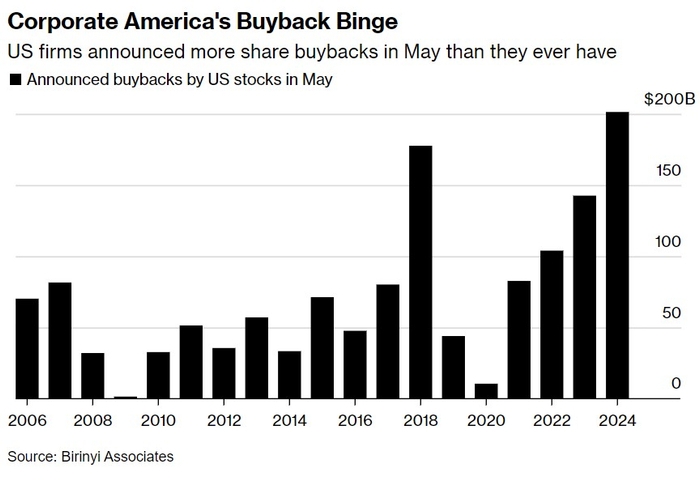

US stock market