In the fast-paced world of finance, staying ahead of the curve is crucial. This is especially true when it comes to stock futures, which can offer valuable insights into the potential direction of the stock market. Whether you're a seasoned investor or just starting out, understanding the latest stock futures is essential for making informed decisions. In this article, we'll delve into what stock futures are, how they work, and why they matter.

What Are Stock Futures?

Stock futures are financial contracts that obligate the buyer to purchase a stock at a predetermined price at a specified future date. These contracts are traded on exchanges, such as the Chicago Mercantile Exchange (CME), and are often used by investors to hedge against potential market volatility.

How Do Stock Futures Work?

Stock futures work by providing a standardized agreement between two parties. The buyer agrees to purchase the stock at the predetermined price, while the seller agrees to sell the stock at that price. This contract is typically settled in cash, meaning that the actual ownership of the stock is not transferred.

Why Do Investors Use Stock Futures?

Investors use stock futures for several reasons:

Understanding the Latest Stock Futures

To make informed decisions, it's important to stay up-to-date with the latest stock futures. Here are some key factors to consider:

Case Study: Apple Stock Futures

Let's take a look at a real-world example involving Apple stock futures. In the days leading up to Apple's earnings report, the stock futures for Apple (AAPL) were trading at

Conclusion

Understanding the latest stock futures is crucial for making informed investment decisions. By staying informed about market trends, economic indicators, and company news, you can better predict the direction of the stock market and protect your investments. Whether you're a seasoned investor or just starting out, knowing how to interpret stock futures can give you a competitive edge in the financial markets.

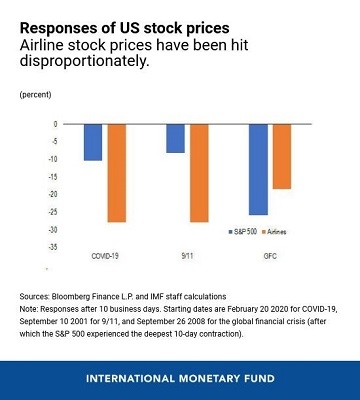

US stock market