In the world of finance, staying abreast of the closing numbers for the stock market is crucial for investors and traders alike. This article delves into the importance of closing numbers, how they are determined, and their implications for the market.

Understanding Closing Numbers

The closing number for the stock market refers to the final value of a stock or the index at the end of trading hours. For a stock, this is often represented by the closing price. For stock indices, such as the S&P 500 or the NASDAQ, the closing number is the value of the index at the end of the trading day.

How Closing Numbers Are Determined

The closing number for a stock is determined by the supply and demand of that stock. When there are more buyers than sellers, the price typically increases, and when there are more sellers than buyers, the price usually decreases. This process continues until the stock reaches equilibrium, which is reflected in the closing price.

Similarly, for stock indices, the closing number is a weighted average of the stocks included in the index. The weighting is often based on the market capitalization of the stocks, with larger companies having a greater influence on the index's closing number.

Implications for the Market

The closing numbers for the stock market have several important implications:

Case Studies

To illustrate the importance of closing numbers, let's look at two case studies:

Conclusion

Understanding the closing numbers for the stock market is essential for anyone interested in investing or trading. By analyzing these numbers, investors and traders can gain valuable insights into market sentiment, make informed decisions, and identify trends. As the market continues to evolve, staying abreast of closing numbers will remain a key component of successful investment strategies.

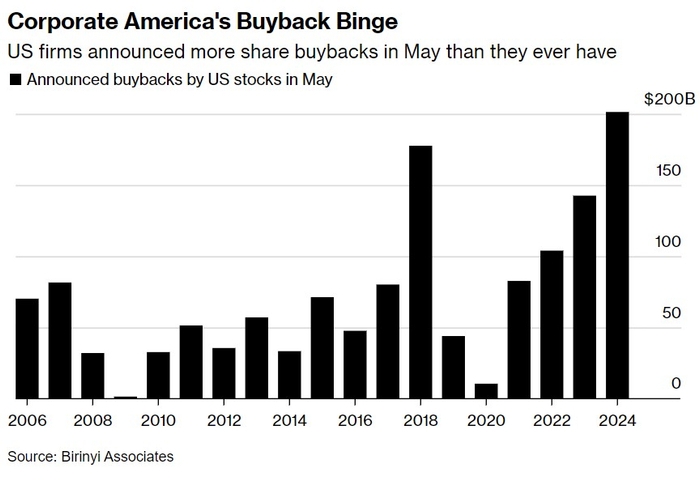

US stock market