In the fast-paced world of trading, understanding the concept of "when stock" is crucial for investors looking to maximize profits and operational efficiency. This article delves into the significance of timing in the stock market, offering insights and strategies to help you make informed decisions.

What is "When Stock"?

When stock refers to the optimal time to buy or sell stocks in order to capitalize on market trends and opportunities. It involves analyzing various factors such as market conditions, news events, and technical indicators to determine the best entry and exit points for your investments.

The Importance of Timing

Timing is everything in the stock market. Buying stocks at the right time can lead to significant gains, while selling at the wrong time can result in substantial losses. By understanding when stock, investors can:

Strategies for Determining When Stock

Technical Analysis: This involves analyzing historical price data and chart patterns to identify trends and predict future price movements. Common technical indicators include moving averages, relative strength index (RSI), and Fibonacci retracement levels.

Fundamental Analysis: This involves evaluating a company's financial health, business model, and market position to determine its intrinsic value. Key factors include earnings per share (EPS), price-to-earnings (P/E) ratio, and revenue growth.

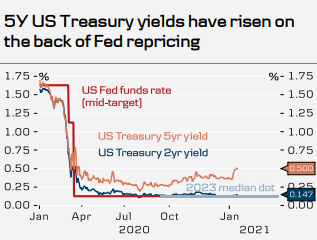

Market Analysis: Keeping an eye on broader market trends and economic indicators can help investors anticipate market movements. Factors such as interest rates, inflation, and political events can significantly impact stock prices.

Case Study: Netflix (NFLX)

Consider Netflix, a leading streaming service provider. In February 2020, amidst the COVID-19 pandemic, Netflix announced a significant increase in subscriber growth. The stock surged as investors anticipated a surge in demand for streaming services during the lockdown. Those who bought Netflix stock at this time saw substantial gains in the following months.

Conclusion

In conclusion, understanding the concept of "when stock" is essential for successful investing. By utilizing strategies such as technical analysis, fundamental analysis, and market analysis, investors can make informed decisions and maximize their returns. Always remember that timing is everything in the stock market, and staying informed is key to success.

US stock industry