In today's fast-paced financial world, managing your personal banking effectively is crucial. One aspect that often goes unnoticed but significantly impacts your investments is the stock trade commissions charged by your bank. In this article, we will delve into the details of Us Bank's personal banking stock trade commissions, ensuring you make informed decisions about your investments.

What are Stock Trade Commissions?

Stock trade commissions are fees charged by banks or brokers for executing stock transactions on behalf of their clients. These fees can vary depending on the bank and the type of transaction. Understanding how these commissions work is essential in managing your investment portfolio efficiently.

Us Bank Personal Banking Stock Trade Commissions: An Overview

Us Bank offers a comprehensive range of personal banking services, including stock trading. Here's an overview of their stock trade commissions:

1. Commission Structure

Us Bank's stock trade commissions vary based on the type of account and the transaction size.

For regular brokerage accounts, the commission is $29.95 per trade, with no minimum balance required.

For investment accounts, the commission is

2. Discounted Rates

Us Bank offers discounted rates for active traders. If you meet certain criteria, such as placing at least 30 trades per quarter, you may qualify for reduced commissions.

3. Other Fees

While Us Bank's stock trade commissions are competitive, it's important to note that there may be additional fees for certain transactions, such as option trading or margin trading.

Understanding the Impact of Commissions on Your Investments

The impact of stock trade commissions on your investments can be significant, especially if you're an active trader. Here's how to evaluate the impact:

*Calculate the Total Cost: Multiply the commission rate by the number of trades you expect to make within a given period. This will give you an idea of the total cost you'll incur. *Compare with Other Brokers: Research and compare Us Bank's commission rates with those of other brokers. This will help you determine if you're getting a competitive deal. *Consider the Quality of Service: While low commissions are important, it's also crucial to consider the overall quality of service provided by the bank, including customer support, platform features, and research tools.

Case Study: John's Experience with Us Bank

John, a 35-year-old IT professional, recently started trading stocks using Us Bank's personal banking services. He decided to trade 50 stocks within a quarter.

By analyzing his trades, John calculated that he would incur a total of $1,497.50 in commissions, based on Us Bank's standard rates. After comparing with other brokers, John found that Us Bank offered competitive rates for his trading volume. Additionally, John was satisfied with the bank's platform and customer support, which helped him make informed investment decisions.

Conclusion

Understanding Us Bank's personal banking stock trade commissions is essential in managing your investment portfolio effectively. By considering the commission structure, evaluating the impact on your investments, and comparing with other brokers, you can make informed decisions that align with your financial goals.

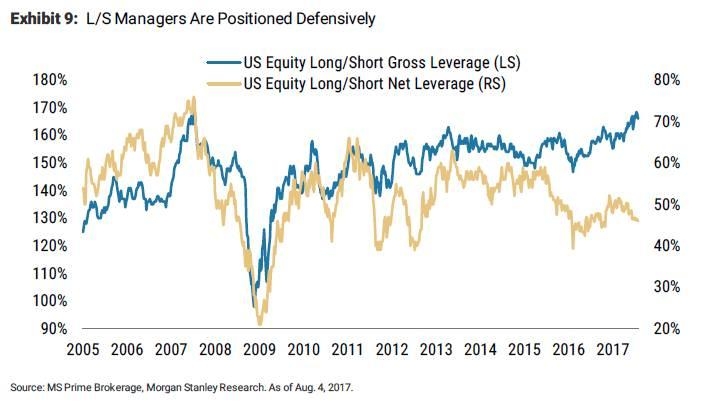

US stock industry