In the ever-evolving world of investing, finding stocks that offer consistent growth and reliable dividends can be a game-changer for your portfolio. US dividend growing stocks have long been a favorite among investors seeking stability and income. This article delves into what these stocks are, why they are beneficial, and how you can identify them.

What Are US Dividend Growing Stocks?

US dividend growing stocks are shares of companies that have a history of increasing their dividends over time. These companies are typically well-established, financially stable, and have a strong track record of profitability. By reinvesting the dividends, investors can benefit from the power of compounding, potentially leading to significant wealth over the long term.

Why Invest in US Dividend Growing Stocks?

There are several reasons why US dividend growing stocks are considered a smart investment strategy:

How to Identify US Dividend Growing Stocks

Identifying US dividend growing stocks requires a bit of research and analysis. Here are some key factors to consider:

Case Study: Procter & Gamble (PG)

One example of a US dividend growing stock is Procter & Gamble (PG). This consumer goods giant has a long history of increasing its dividends, making it a popular choice among income investors. With a strong brand presence and a diverse product portfolio, PG has consistently generated profits and provided shareholders with growing dividends.

In conclusion, US dividend growing stocks offer a smart investment strategy for those seeking stability, income, and growth potential. By conducting thorough research and analyzing key factors, investors can identify companies that have the potential to deliver long-term returns.

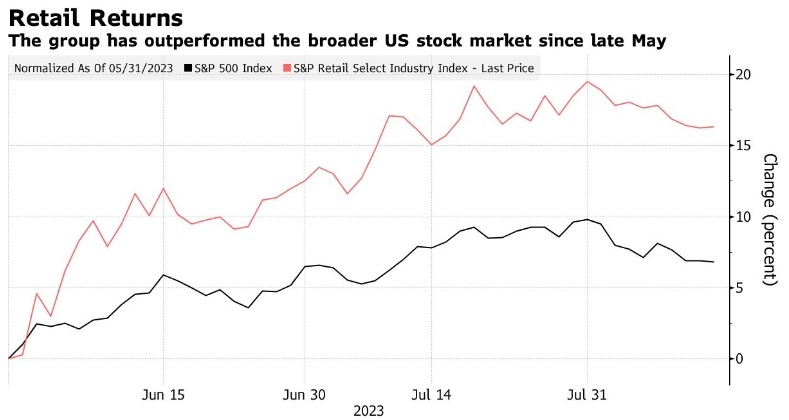

US stock industry