Introduction: Investing in blue chip stocks with high dividends has long been a strategy favored by many investors. These stocks represent well-established companies with a strong financial track record and stable dividends. In this article, we will explore the top 5 high dividend blue chip stocks in the US and why they are worth considering for your investment portfolio.

Exxon Mobil Corporation (XOM) Exxon Mobil is one of the largest oil and gas companies in the world. With a dividend yield of approximately 5.5%, it is a top choice for income investors. The company has a long history of increasing its dividend payments, making it a reliable source of income. Exxon Mobil’s strong presence in the energy sector and its diversification in oil and gas exploration and production make it a solid investment.

Johnson & Johnson (JNJ) Johnson & Johnson is a diversified healthcare company known for its consumer products, pharmaceuticals, and medical devices. The company offers a dividend yield of around 2.7% and has a strong history of increasing its dividend payments. JNJ’s robust product portfolio and its leadership in healthcare make it a resilient investment, especially in times of economic uncertainty.

Procter & Gamble (PG) Procter & Gamble is a leading consumer goods company with a diverse range of products, including household cleaning, personal care, and beauty products. With a dividend yield of about 2.5%, P&G is another top pick for income investors. The company has a long history of increasing its dividend payments, making it a stable source of income. P&G’s strong brand presence and its global reach make it a solid investment for long-term growth.

Walmart Inc. (WMT) Walmart is the world’s largest retailer and offers a dividend yield of around 1.6%. The company has a long history of increasing its dividend payments and has been consistently generating strong returns for its shareholders. Walmart’s cost leadership and its expansion into e-commerce make it a resilient investment, especially in times of economic uncertainty.

Apple Inc. (AAPL) Apple is the world’s largest technology company and offers a dividend yield of about 1.2%. Although the yield is lower compared to other companies on this list, Apple has a strong track record of increasing its dividend payments. The company’s diversified product portfolio, including iPhones, iPads, and Macs, makes it a solid investment for long-term growth. Apple’s strong financial position and its leadership in the technology sector make it a top choice for investors seeking exposure to the tech industry.

Conclusion: Investing in high dividend blue chip stocks can provide investors with a stable source of income and exposure to well-established companies with strong financial track records. The top 5 high dividend blue chip stocks in the US—Exxon Mobil, Johnson & Johnson, Procter & Gamble, Walmart, and Apple—offer investors a mix of income and growth potential. As always, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

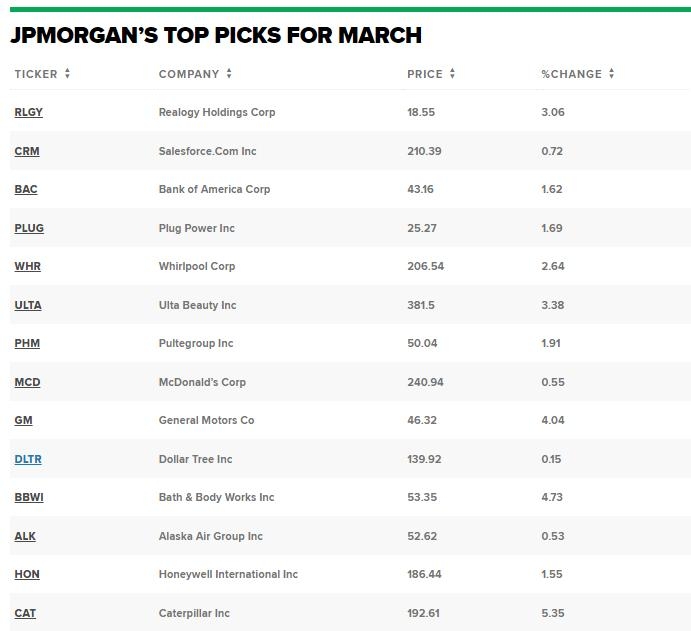

US stock industry