In today's fast-paced financial world, understanding the nuances of stock investments is crucial for anyone looking to grow their wealth. "Stockas" is a term that encapsulates the essence of stock market investments, emphasizing the strategies and tools needed to succeed. This article delves into the world of stockas, providing insights on how to maximize returns and navigate the volatile stock market.

Understanding Stockas

At its core, "stockas" refers to the act of purchasing and selling shares of publicly traded companies. These shares represent ownership in a company and can be bought and sold on stock exchanges. By investing in stocks, individuals can potentially earn profits through capital gains and dividends.

The Importance of Research

One of the most critical aspects of engaging in stockas is thorough research. Before investing, it's essential to understand the company's financial health, industry position, and market trends. This involves analyzing financial statements, reading company reports, and staying updated with industry news.

Diversification: A Key Strategy

Diversification is a fundamental strategy in stockas. By investing in a variety of stocks across different sectors and industries, investors can mitigate risks associated with market volatility. A well-diversified portfolio can help stabilize returns and reduce the impact of a single stock's poor performance.

Utilizing Stock Analysis Tools

To excel in stockas, investors often rely on various analysis tools. These tools can help identify potential investment opportunities, track market trends, and make informed decisions. Some popular tools include stock screening platforms, technical analysis software, and fundamental analysis tools.

Case Study: Apple Inc.

A prime example of successful stockas is the investment in Apple Inc. (AAPL). Over the years, Apple has consistently delivered strong financial performance and innovative products, leading to significant growth in its stock price. Investors who stayed committed to their investment in Apple have seen substantial returns.

The Role of Risk Management

Risk management is a crucial component of stockas. It involves setting clear investment goals, determining risk tolerance, and implementing strategies to protect investments. Techniques such as stop-loss orders and position sizing can help minimize potential losses.

Conclusion

Stockas is a dynamic and complex field that requires knowledge, research, and strategy. By understanding the principles of stockas and employing effective investment strategies, individuals can navigate the stock market and achieve their financial goals. Whether you're a seasoned investor or just starting out, embracing the power of stockas can pave the way for a prosperous financial future.

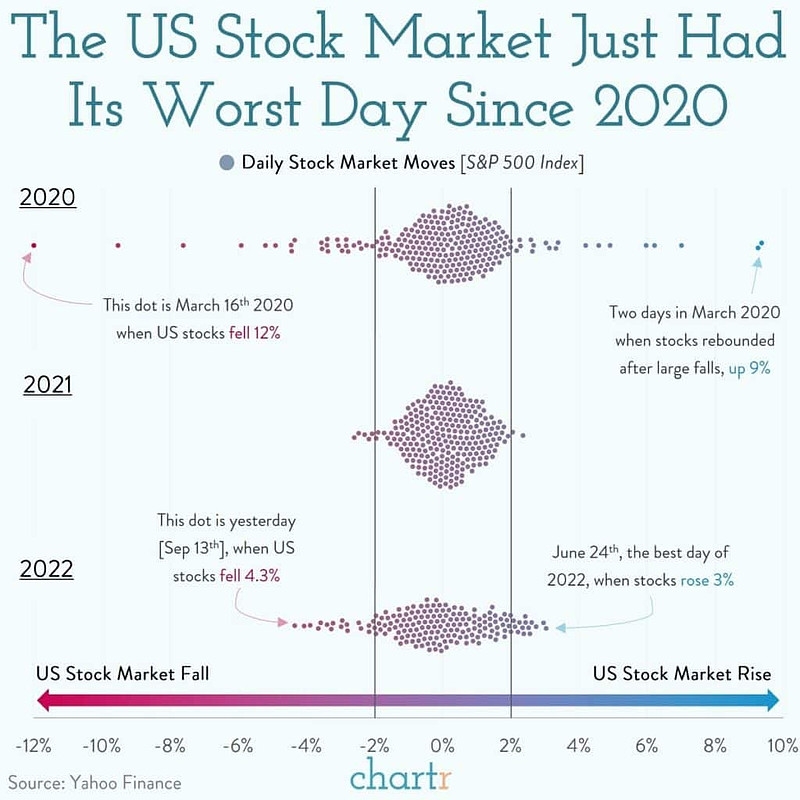

US stock industry