Introduction:

The financial markets are facing turbulent times as concerns about the United States' economic growth are causing a slide in global stocks. Investors are increasingly worried about the potential impact of various factors, including rising inflation, trade tensions, and geopolitical risks. This article delves into the key reasons behind this downturn and examines the broader implications for the global economy.

Rising Inflation and Interest Rates:

One of the primary reasons for the slide in global stocks is the rising inflation and subsequent increase in interest rates. The Federal Reserve has been raising interest rates to combat inflation, which has reached its highest level in decades. This has led to higher borrowing costs for businesses and consumers, which in turn has dampened economic growth and increased uncertainty in the market.

Trade Tensions and Geopolitical Risks:

Trade tensions between the United States and its major trading partners, including China, have also contributed to the slide in global stocks. These tensions have led to increased tariffs and trade barriers, which have disrupted global supply chains and raised costs for businesses. Additionally, geopolitical risks, such as tensions in the Middle East and the situation in Ukraine, have added to the uncertainty in the market.

Case Study:

A prime example of the impact of trade tensions on the global stock market is the recent situation between the United States and China. The imposition of tariffs on each other's goods has led to higher prices for consumers and increased costs for businesses. This has had a significant impact on companies that rely on these markets, leading to a decline in their stock prices.

Impact on the Global Economy:

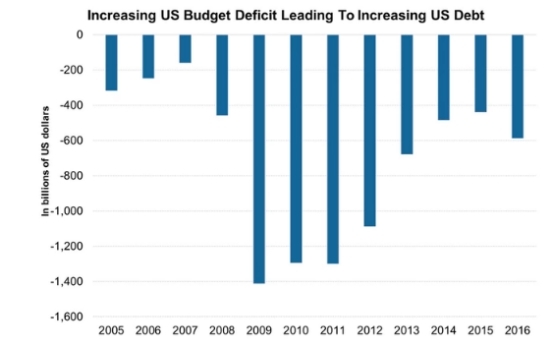

The slide in global stocks is not just a concern for investors but also for the broader global economy. A slowdown in economic growth in the United States could have a ripple effect on other economies, particularly those that are closely tied to the US market. This could lead to a global economic downturn, with negative consequences for businesses, consumers, and governments worldwide.

Conclusion:

The slide in global stocks, driven by concerns over US growth, is a clear indication of the challenges facing the global economy. As investors grapple with rising inflation, trade tensions, and geopolitical risks, it is crucial for them to stay informed and make informed decisions. While the current situation is uncertain, it is essential to remain vigilant and prepared for potential changes in the market.

US stock industry