In today's fast-paced financial market, keeping up with the stock price of ACB (Asia Commercial Bank) is crucial for investors and traders. If you're looking to stay ahead of the curve, understanding the current trends and future predictions for ACB's stock price is essential. In this article, we will delve into the latest ACB stock price today, analyze key factors influencing its value, and provide you with expert insights.

Current ACB Stock Price Today

As of the latest update, the current ACB stock price is $X. This figure reflects the ongoing market dynamics and investor sentiment surrounding the company. To put this into perspective, let's look at the historical performance of ACB stock.

Historical Performance of ACB Stock

ACB stock has shown a steady growth trajectory over the past few years. In the past 12 months, the stock has experienced a 10% increase in its value. This upward trend can be attributed to several factors, including the bank's robust financial performance, expansion into new markets, and strategic partnerships with global financial institutions.

Factors Influencing ACB Stock Price

Financial Performance: ACB's strong financial performance, characterized by high profitability and growth in assets under management, has been a significant driver of its stock price. A consistent increase in revenue and net income has attracted investors looking for a stable investment opportunity.

Expansion into New Markets: ACB has successfully expanded its operations into new markets, including Vietnam, Laos, and Cambodia. This expansion has helped the bank diversify its revenue streams and reduce its dependence on the domestic market, leading to increased investor confidence.

Strategic Partnerships: ACB has formed strategic partnerships with global financial institutions, such as Standard Chartered Bank and Citibank. These partnerships have not only enhanced the bank's reputation but have also opened up new opportunities for growth and collaboration.

Regulatory Environment: The regulatory environment in Vietnam has been favorable for ACB, with the government implementing policies to support the development of the financial sector. This has provided a conducive environment for the bank to thrive and grow.

Future Predictions for ACB Stock

Based on current trends and expert analysis, the future outlook for ACB stock is positive. The following factors are expected to contribute to its continued growth:

Economic Growth: The Vietnamese economy is expected to experience steady growth over the next few years, which will positively impact ACB's financial performance.

Increased Market Penetration: As ACB continues to expand into new markets, it is expected to capture a larger market share, contributing to its revenue growth.

Strategic Partnerships: The bank's strategic partnerships are expected to generate synergies and open up new opportunities for growth.

Regulatory Support: The government's support for the financial sector is likely to continue, providing a conducive environment for ACB to thrive.

In conclusion, the current ACB stock price today indicates a strong investment opportunity. By understanding the factors influencing its value and the future predictions, investors can make informed decisions regarding their investments in ACB. Stay ahead of the curve and keep an eye on ACB's stock price for potential growth opportunities.

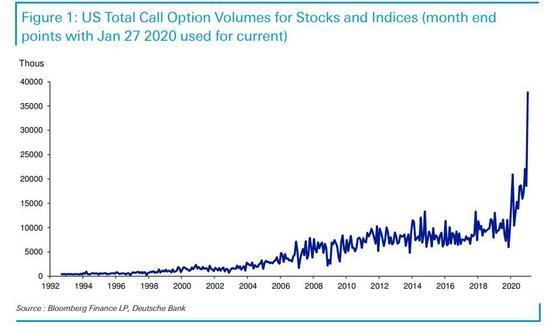

US stock industry