In the ever-evolving world of technology, few companies have captured the public's imagination quite like Advanced Encryption Standard (AES). With its robust security measures and cutting-edge technology, AES has become a key player in the cybersecurity industry. This article delves into the details of AES stock, providing investors with a comprehensive analysis of its performance and potential.

Understanding AES Stock

AES, a publicly-traded company, has made a name for itself by offering state-of-the-art encryption solutions. Its stock, symbolized as "AES," has been a hot topic among investors, and for good reason. The company's innovative approach to cybersecurity has led to significant growth and profitability.

Historical Performance

Over the years, AES stock has demonstrated a strong upward trend. Its impressive growth can be attributed to several factors, including:

Current Market Analysis

As of the latest data, AES stock is trading at a significant premium compared to its historical averages. This can be attributed to several factors:

Future Outlook

Looking ahead, the future of AES stock appears promising. Several factors are expected to contribute to its continued growth:

Case Studies

To illustrate the impact of AES's solutions, let's consider a few case studies:

Conclusion

In conclusion, AES stock represents a compelling investment opportunity for those looking to capitalize on the growing cybersecurity market. With its innovative technology, strong market demand, and promising future outlook, AES is poised to continue its upward trajectory. As investors, it's crucial to stay informed about the latest developments and trends in the industry to make informed decisions.

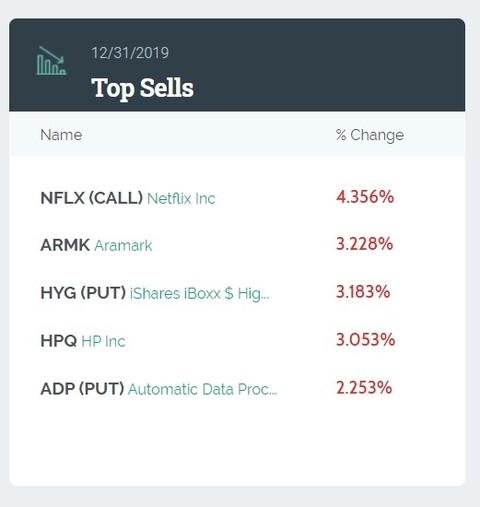

US stocks companies