In the world of financial markets, staying ahead of the curve is crucial. One of the most effective ways to do so is by keeping a close eye on CNN premarket futures. These tools offer valuable insights into market trends and potential movements before the official trading day begins. In this article, we'll delve into what CNN premarket futures are, how they work, and why they are essential for investors and traders alike.

What Are CNN Premarket Futures?

CNN premarket futures are a type of financial instrument that allows investors and traders to speculate on the direction of the market before the official trading day begins. These futures are based on various indices, including the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. By tracking these futures, you can gain a better understanding of market sentiment and potential movements in the coming hours.

How Do CNN Premarket Futures Work?

CNN premarket futures operate on the same principles as regular futures contracts but are traded before the official market open. Here's a basic overview of how they work:

Why Are CNN Premarket Futures Important?

There are several reasons why CNN premarket futures are important for investors and traders:

Case Study: CNN Premarket Futures in Action

To illustrate the importance of CNN premarket futures, let's consider a hypothetical scenario. Imagine that you're an investor looking to buy shares of a particular company. By monitoring CNN premarket futures, you notice that the S&P 500 futures are indicating a positive trend. This may suggest that the market is likely to open higher, and you might decide to buy the shares of the company you're interested in.

Conclusion

In conclusion, CNN premarket futures are a valuable tool for investors and traders looking to stay ahead of the curve. By understanding how these futures work and the insights they provide, you can make more informed decisions and manage your risk more effectively. So, next time you're preparing for the trading day, don't forget to check out the CNN premarket futures for valuable insights into market trends and potential movements.

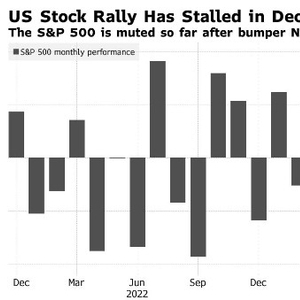

US stocks companies