The ongoing US-China trade war has sent ripples through global markets, affecting various sectors and industries. As investors navigate this tumultuous landscape, understanding the potential opportunities and risks associated with US-China trade war stocks is crucial. This article delves into the impact of the trade war on the stock market, highlighting key sectors and companies to watch.

Impact on the Stock Market

The trade war has led to increased tariffs on goods and services between the two countries, resulting in higher costs for businesses and uncertainty in the market. This uncertainty has caused volatility in the stock market, with some sectors being hit harder than others.

Key Sectors Affected

Technology Stocks: The technology sector has been particularly affected by the trade war, with companies like Apple and Huawei facing increased tariffs. Apple has seen a decline in sales in China, its second-largest market, while Huawei has been targeted with restrictions on its access to US technology.

Automotive Stocks: The automotive industry has also been impacted, with companies like Ford and General Motors facing higher costs due to tariffs on steel and aluminum imports from China.

Consumer Goods Stocks: The consumer goods sector has seen a mixed impact, with some companies benefiting from increased demand for domestically produced goods while others have faced higher costs and reduced consumer spending.

Opportunities in US-China Trade War Stocks

Despite the challenges, there are opportunities for investors in US-China trade war stocks:

Domestic Manufacturing: As tariffs increase, companies that have shifted production to the US or other countries may see increased demand for their products.

Alternative Supply Chains: Companies that have diversified their supply chains to reduce dependence on China may benefit from the trade war.

Defensive Stocks: Certain sectors, such as healthcare and consumer staples, may offer defensive opportunities as consumers seek to maintain their spending habits during uncertain times.

Case Studies

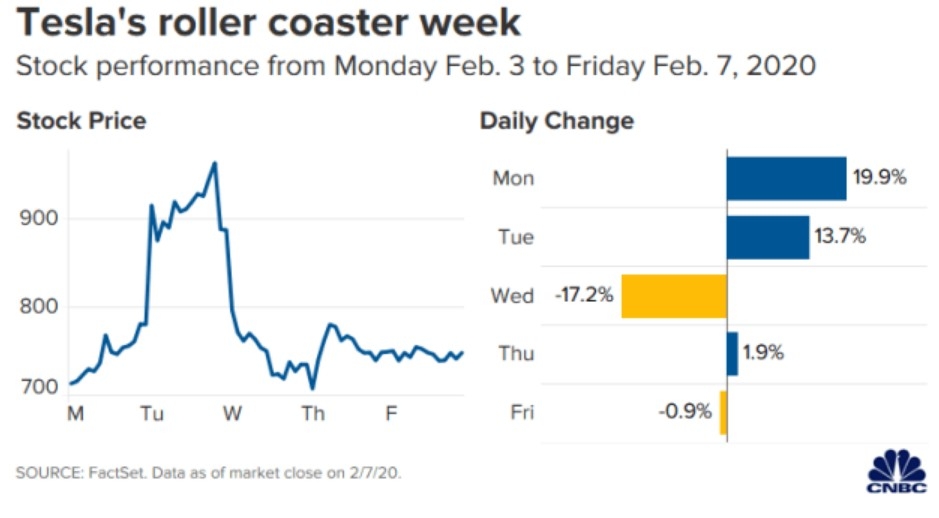

Tesla: Tesla has been actively seeking to diversify its supply chain to reduce its reliance on Chinese suppliers. The company has announced plans to build a factory in Shanghai, China, which could help mitigate some of the trade war's impact.

Nike: Nike has been facing increased competition from domestic brands in China. However, the company has been investing in its direct-to-consumer business and digital marketing efforts to maintain its market share.

Conclusion

The US-China trade war presents both challenges and opportunities for investors. By understanding the impact on key sectors and companies, investors can identify potential opportunities and manage risks effectively. As the trade war continues to unfold, staying informed and adapting to changing market conditions will be crucial for success.

US stocks companies