This week, the stock market has been buzzing with a mix of positive and negative news, leaving investors on edge. In this article, we'll delve into the key developments and predictions for the stock market this week. From major corporate earnings to geopolitical tensions, we'll cover it all.

Major Corporate Earnings

One of the standout themes this week has been the release of major corporate earnings reports. Many companies have reported better-than-expected earnings, boosting investor confidence. For instance, Apple reported strong sales of its iPhone and Mac products, leading to a surge in its stock price. Similarly, Microsoft and Amazon also reported robust earnings, driving their shares higher.

Geopolitical Tensions

However, the stock market has also been impacted by geopolitical tensions. The ongoing conflict in Eastern Europe has raised concerns about global economic stability. As a result, investors have been selling off stocks, leading to a slight decline in the market. This has particularly affected sectors like energy and financials, which are sensitive to geopolitical events.

Sector Performance

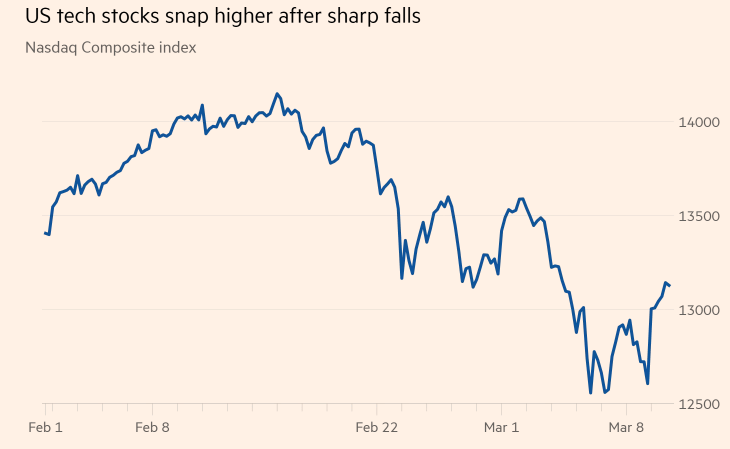

This week, the technology sector has been the standout performer. Companies like Tesla and NVIDIA have seen significant gains, driven by strong earnings and positive outlooks. On the other hand, the energy sector has been hit hard by the geopolitical tensions, with companies like ExxonMobil and Chevron experiencing declines.

Market Predictions

Looking ahead, experts are divided on where the stock market is headed. Some believe that the recent volatility is a sign of a market correction, while others see it as a temporary blip. Here are a few key predictions:

Case Study: Tesla

To illustrate the impact of corporate earnings on the stock market, let's take a look at Tesla. After reporting strong earnings, Tesla's stock price surged by more than 10%. This highlights the importance of earnings reports in driving stock prices.

Conclusion

This week has been a rollercoaster ride for the stock market, with a mix of positive and negative news. While the market has seen some volatility, the overall trend remains upward. As always, investors should stay informed and make informed decisions based on their individual risk tolerance.

US stocks companies