In recent times, the stock market has experienced a significant downturn, prompting many investors to question the stability of their portfolios. This article delves into the reasons behind the stock market's losses, the potential impacts, and strategies for recovery.

Reasons for the Stock Market Downturn

Several factors have contributed to the recent losses in the stock market. One of the primary reasons is the global economic uncertainty caused by the COVID-19 pandemic. The pandemic has disrupted supply chains, caused job losses, and led to reduced consumer spending, all of which have had a negative impact on the stock market.

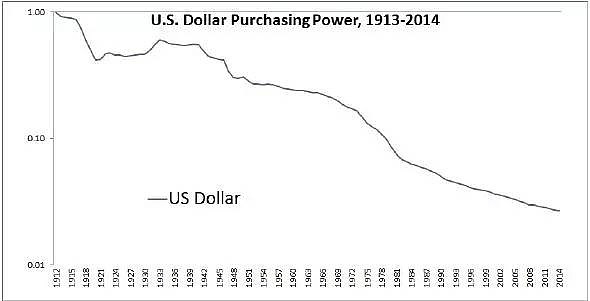

Another factor is the rising inflation rates. As the economy recovers, businesses are facing increased costs, which they are passing on to consumers. This, in turn, leads to reduced consumer spending and can cause the stock market to lose value.

Lastly, the market has been affected by political uncertainties, such as the ongoing trade tensions between the United States and China.

Impacts of the Stock Market Downturn

The recent losses in the stock market have had several impacts. For investors, it has led to significant losses in their portfolios. This can be particularly devastating for those who are nearing retirement and rely on their investments for income.

For businesses, the stock market downturn has made it more difficult to raise capital. This can lead to reduced growth and expansion opportunities.

For the economy as a whole, the stock market downturn can lead to reduced consumer confidence and spending, which can further slow economic growth.

Strategies for Recovery

Despite the recent losses, there are several strategies investors can use to recover their investments.

Firstly, diversifying your portfolio can help mitigate the risks associated with a stock market downturn. By investing in a variety of assets, including stocks, bonds, and real estate, you can reduce the impact of any single market downturn.

Secondly, staying the course and not reacting to short-term market volatility is crucial. History has shown that the stock market tends to recover over the long term, so it's important to stay focused on your long-term investment goals.

Lastly, seeking professional financial advice can be beneficial. A financial advisor can help you assess your portfolio and provide personalized advice on how to recover from the recent stock market losses.

Case Study: Apple Inc.

One notable example of a company that has been affected by the stock market downturn is Apple Inc. The company's stock price has fallen significantly in recent months, primarily due to concerns about supply chain disruptions and reduced consumer demand.

However, despite the recent losses, Apple remains a strong and stable company with a solid financial position. The company's long-term prospects remain positive, and investors who have stayed the course are likely to see their investments recover over time.

Conclusion

The recent stock market downturn has been a challenging time for investors. However, by understanding the reasons behind the losses and adopting effective recovery strategies, investors can navigate these turbulent times and ultimately achieve their long-term investment goals.

US stocks companies