Investing in the stock market is a pivotal decision for many households in the United States. How individuals allocate their investments among different stocks can significantly impact their financial future. This article delves into the various factors influencing stock allocation among US households, providing a comprehensive overview of the landscape.

Understanding Stock Allocation

Stock allocation refers to the process of dividing an investment portfolio among different stocks. This diversification is crucial for managing risk and maximizing returns. The key to successful stock allocation lies in understanding one's financial goals, risk tolerance, and investment horizon.

Factors Influencing Stock Allocation

Several factors influence stock allocation among US households:

- Financial Goals: Different financial goals call for different investment strategies. For instance, long-term growth-oriented investors might allocate more to stocks with high growth potential, while those focusing on capital preservation might prefer more stable, dividend-paying stocks.

- Risk Tolerance: Investors with a higher risk tolerance may be more comfortable allocating a larger portion of their portfolio to stocks, while those with lower risk tolerance might prefer bonds or other fixed-income investments.

- Investment Horizon: The time frame for achieving financial goals also plays a role in stock allocation. Investors with a longer time horizon may be more willing to take on higher risks for potentially higher returns.

- Market Conditions: Economic conditions, industry trends, and geopolitical events can influence stock allocation. Investors may adjust their portfolios accordingly to capitalize on market opportunities or mitigate risks.

Common Stock Allocation Strategies

Several common stock allocation strategies are prevalent among US households:

- Asset Allocation: This strategy involves dividing investments among different asset classes, such as stocks, bonds, and real estate. The goal is to balance risk and return while achieving the desired financial goals.

- Diversification: Diversifying a portfolio across various sectors, industries, and geographic regions can help reduce risk and enhance returns.

- Value Investing: This strategy involves investing in stocks that are trading below their intrinsic value. Value investors often focus on undervalued companies with strong fundamentals.

- Growth Investing: Growth investors seek out companies with high growth potential, often investing in emerging industries or startups.

Case Study: Retirement Portfolios

Retirement portfolios are a prime example of how stock allocation can differ among households. Consider two individuals, John and Sarah, both 30 years old and planning for retirement in 30 years.

- John: With a higher risk tolerance and long-term investment horizon, John allocates 60% of his retirement portfolio to stocks, focusing on companies with high growth potential in emerging industries.

- Sarah: With a lower risk tolerance and a shorter investment horizon, Sarah allocates only 40% of her retirement portfolio to stocks, with the remaining portion in bonds and other fixed-income investments.

Conclusion

Stock allocation among US households is a complex and personalized process. Understanding one's financial goals, risk tolerance, and investment horizon is crucial for creating a well-diversified portfolio. By considering the various factors influencing stock allocation and adopting a suitable strategy, investors can enhance their chances of achieving their financial goals.

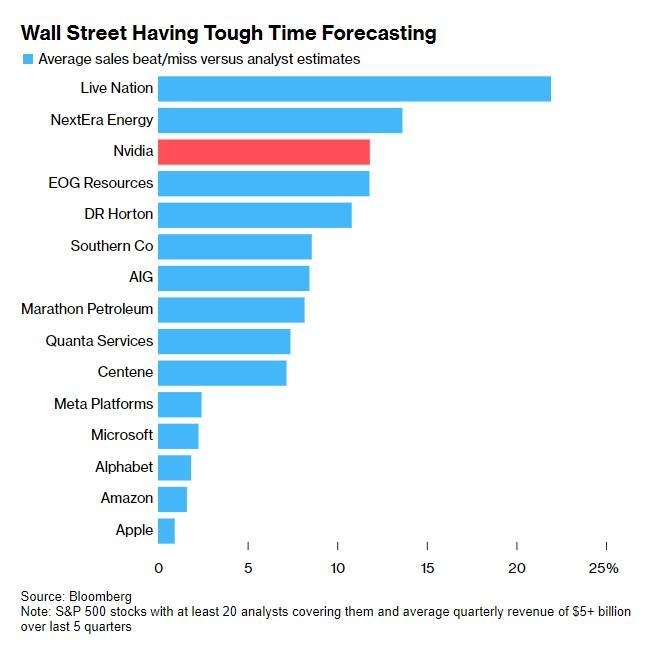

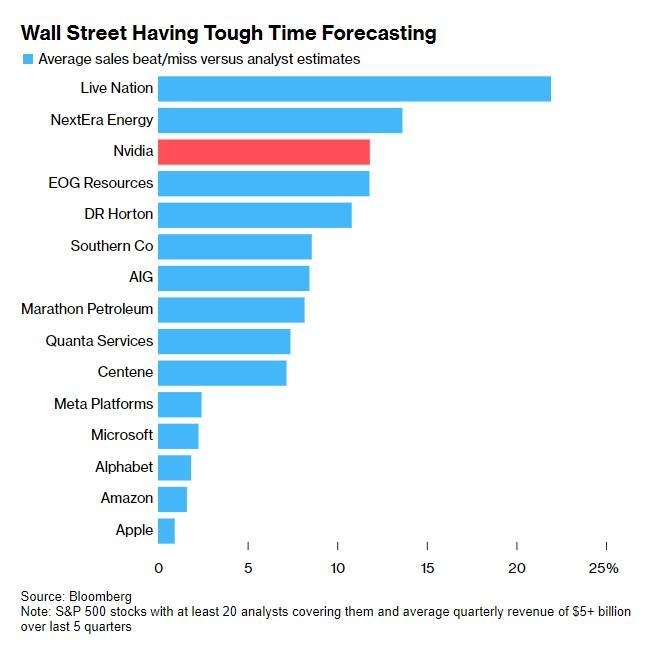

US stocks companies