Understanding the Process

If you're in the market for importing rifle stocks into the United States, it's crucial to understand the ins and outs of the customs process. This guide will provide you with a comprehensive overview of what you need to know to ensure a smooth and compliant import.

Importing Rifle Stocks: What You Need to Know

1. Legal Requirements

2. Customs Declaration

When importing a rifle stock, you must complete a customs declaration. This includes providing accurate information about the item, such as its description, quantity, and value. It's crucial to be thorough and honest in your declaration to avoid potential delays or penalties.

3. Duties and Taxes

You may be responsible for paying duties and taxes on the imported rifle stock. The rates vary depending on the type of rifle stock and its value. It's advisable to consult with a customs broker or a professional to ensure you understand all applicable fees.

4. Compliance with Firearms Regulations

In addition to customs requirements, you must also comply with federal, state, and local firearms regulations. This includes ensuring that the rifle stock is suitable for the firearm you intend to use it with and that you have the legal right to possess it in your jurisdiction.

Case Study: Importing a Custom Rifle Stock

Imagine you're a firearms enthusiast looking to import a custom rifle stock from a reputable manufacturer in Europe. Here's how you would navigate the process:

Conclusion

Importing rifle stocks into the United States requires careful attention to legal requirements, customs procedures, and firearms regulations. By following this guide and understanding the process, you can ensure a successful and compliant import.

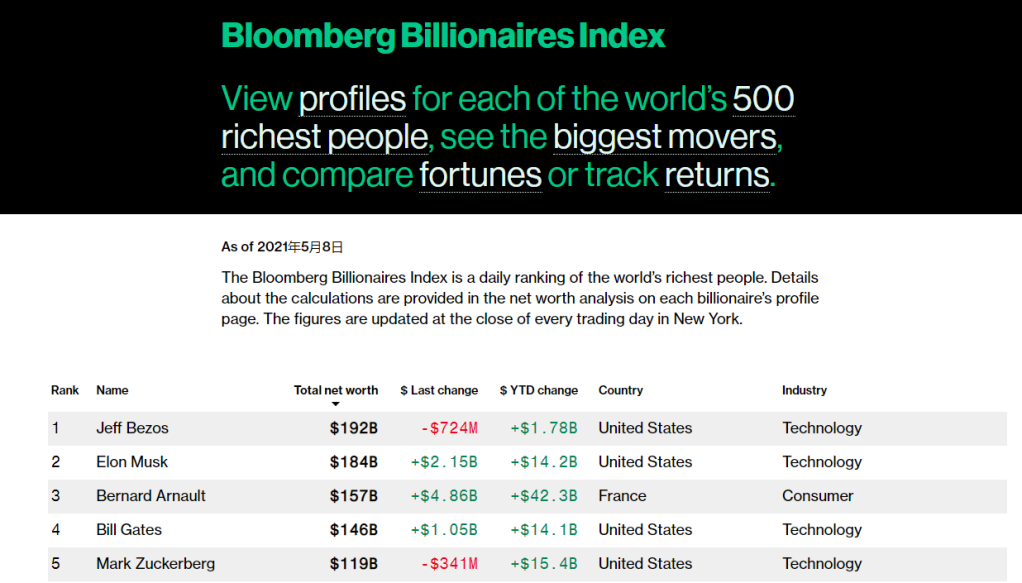

US stocks companies