In recent years, there has been a significant increase in Canadian investors looking to diversify their portfolios by investing in US stocks. This trend is driven by several factors, including the strong performance of the US stock market, the favorable exchange rate, and the ease of investing in US stocks. This article will provide a comprehensive guide to help Canadian investors understand the process of investing in US stocks.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world. It is home to many of the world's largest and most successful companies, including tech giants like Apple, Microsoft, and Google. The US stock market is divided into two main exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. Both exchanges offer a wide range of investment opportunities, from large-cap blue-chip stocks to small-cap growth stocks.

Why Invest in US Stocks?

There are several reasons why Canadian investors might consider investing in US stocks:

- Strong Performance: The US stock market has historically provided higher returns than the Canadian market. This is due to the presence of large, profitable companies with strong growth prospects.

- Diversification: Investing in US stocks can help Canadian investors diversify their portfolios and reduce their exposure to the domestic market.

- Favorable Exchange Rate: The current exchange rate between the Canadian dollar and the US dollar is favorable for Canadian investors looking to invest in US stocks.

- Ease of Access: It is now easier than ever for Canadian investors to invest in US stocks. There are many online brokers and platforms that offer seamless and cost-effective access to the US stock market.

How to Invest in US Stocks

Investing in US stocks from Canada is a straightforward process. Here are the steps you need to follow:

- Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to the US stock market. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

- Fund Your Account: Once your brokerage account is set up, you will need to fund it with Canadian dollars. Most brokers offer the option to transfer funds from your Canadian bank account.

- Research and Select Stocks: Research and identify the stocks you want to invest in. Consider factors such as the company's financial health, growth prospects, and valuation.

- Place Your Order: Once you have selected your stocks, you can place your order through your brokerage account. Most brokers offer the option to place market orders, limit orders, and stop orders.

Case Study: Investing in Apple (AAPL)

One popular US stock among Canadian investors is Apple (AAPL). Apple is a well-known tech giant that has consistently delivered strong financial results. Here's how a Canadian investor might go about investing in Apple:

- Open a Brokerage Account: The investor opens a brokerage account with a broker that offers access to the US stock market.

- Fund the Account: The investor transfers funds from their Canadian bank account to their brokerage account.

- Research and Analyze: The investor researches Apple's financial health, growth prospects, and valuation.

- Place the Order: The investor places a market order to buy Apple stock through their brokerage account.

Conclusion

Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. By following the steps outlined in this article, Canadian investors can easily and effectively invest in US stocks.

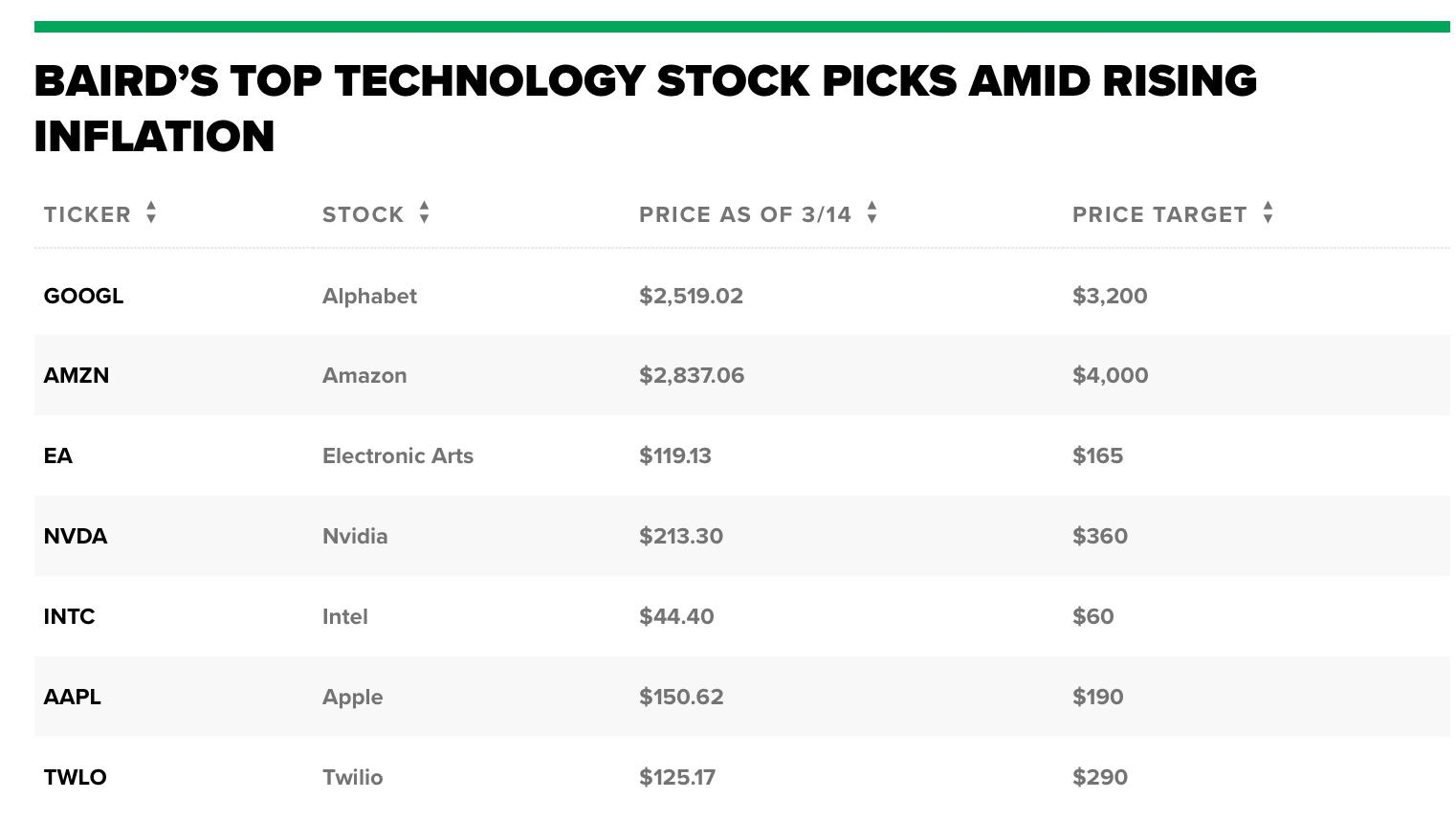

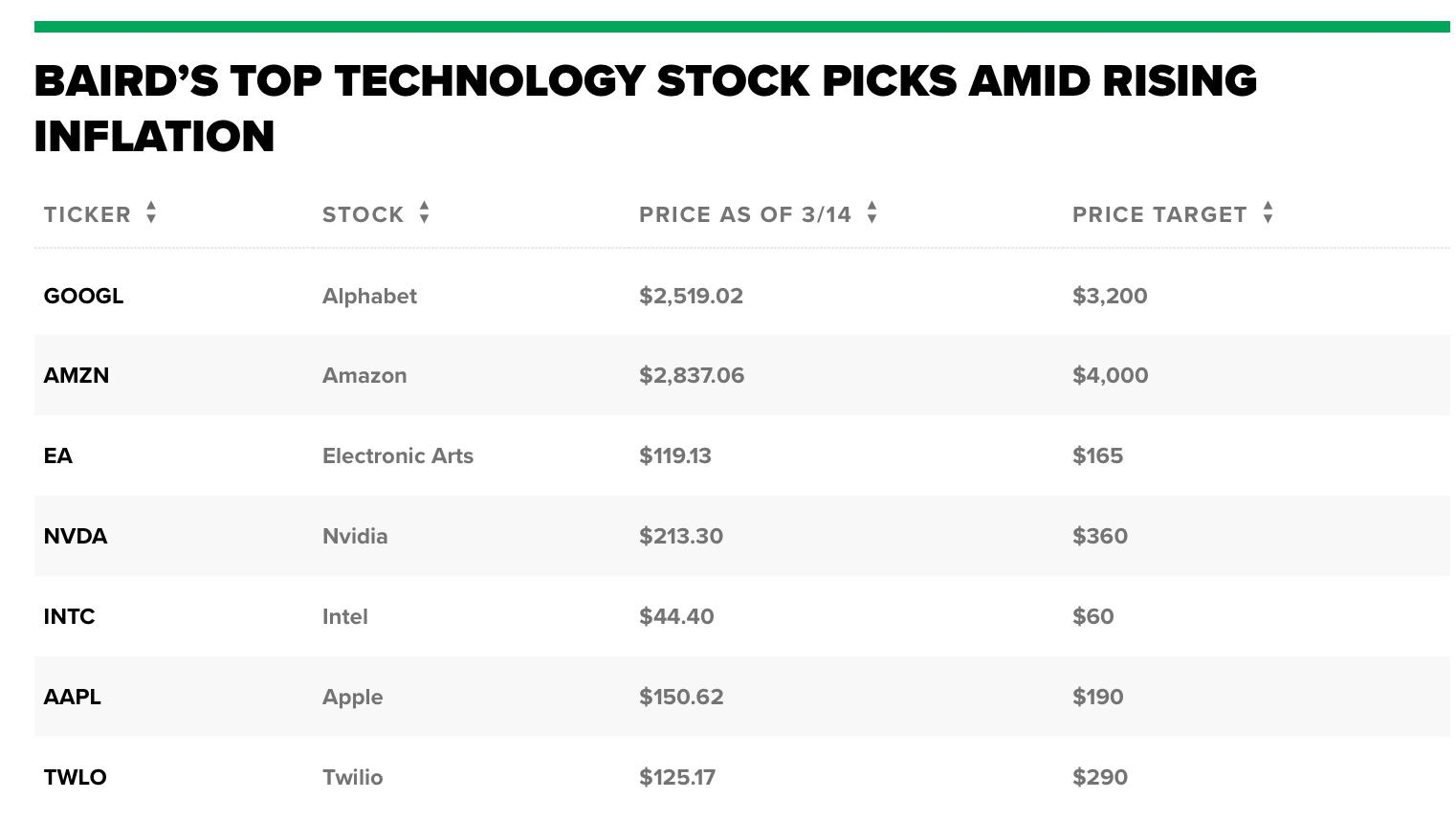

stock information disclosure