Introduction: In the ever-evolving world of commodities, understanding the stock prices of mining companies like Contango Minerals is crucial for investors. This article delves into the factors influencing Contango Minerals' US stock price, providing a comprehensive analysis that can help investors make informed decisions. By examining historical data, market trends, and company-specific factors, we aim to offer valuable insights into the current and future performance of Contango Minerals.

Historical Stock Price Performance: Contango Minerals has experienced significant fluctuations in its stock price over the years. To understand the current market sentiment, it is essential to analyze its historical performance. By examining past stock charts and market trends, we can identify patterns and potential indicators of future price movements.

Market Trends: Several market trends play a crucial role in determining the stock price of Contango Minerals. These trends include global commodity prices, industry-specific factors, and economic indicators. By analyzing these trends, we can gain a better understanding of the potential risks and opportunities associated with investing in Contango Minerals.

Global Commodity Prices: Global commodity prices are a significant factor influencing Contango Minerals' stock price. As a mining company, Contango Minerals' profitability is closely tied to the prices of the commodities it produces, such as gold, silver, and copper. Fluctuations in these prices can have a direct impact on the company's revenue and, subsequently, its stock price.

Industry-Specific Factors: Industry-specific factors also play a vital role in the stock price of Contango Minerals. This includes regulatory changes, technological advancements, and competition within the mining industry. By keeping a close eye on these factors, investors can anticipate potential shifts in Contango Minerals' performance.

Economic Indicators: Economic indicators, such as GDP growth, inflation rates, and currency fluctuations, can also impact the stock price of Contango Minerals. These indicators reflect the overall economic environment and can influence the demand for commodities, ultimately affecting the company's profitability.

Company-Specific Factors: Company-specific factors are crucial in evaluating the potential of Contango Minerals. These factors include the company's financial health, management team, and operational efficiency. A strong balance sheet, experienced management, and efficient operations can contribute to a positive stock price performance.

Case Studies: To illustrate the impact of various factors on Contango Minerals' stock price, let's consider a few case studies:

In 2019, when gold prices surged, Contango Minerals' stock price experienced a significant increase. This highlights the influence of global commodity prices on the company's stock performance.

In 2020, the COVID-19 pandemic led to a decline in commodity prices, negatively impacting Contango Minerals' stock price. This case study emphasizes the vulnerability of mining companies to global economic downturns.

In 2021, Contango Minerals successfully implemented a new mining technology, improving its operational efficiency. This resulted in an increase in the company's stock price, showcasing the importance of company-specific factors.

Conclusion: Understanding the factors influencing Contango Minerals' US stock price is essential for investors looking to invest in the mining industry. By analyzing historical data, market trends, and company-specific factors, investors can make informed decisions. As the global economy continues to evolve, keeping a close eye on these factors will be crucial in evaluating the potential of Contango Minerals and other mining companies.

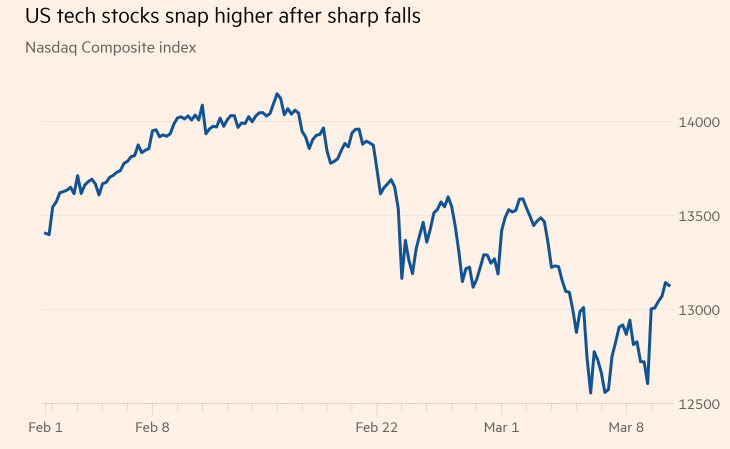

US stock market